Advertisement|Remove ads.

MSTR Avoids MSCI Exclusion, But Critics Warn That Risks Remain

- Critics argued that Strategy’s valuation resembles a leveraged Bitcoin proxy rather than an operating company.

- Preferred equity offerings such as STRC have drawn renewed scrutiny over risk and lack of asset backing.

- MSCI has planned a broader consultation on non-operating companies, leaving long-term index treatment unresolved.

Michael Saylor-backed Strategy (MSTR) avoided potential removal from key MSCI indexes this week, but critics argued that the reprieve does little to address deeper concerns about the stock’s structure, valuation, and future index demand.

MSCI said late Tuesday it would not proceed with a proposal to exclude Digital Asset Treasuries ( DATs) from the MSCI Global Investable Market Indexes during its February 2026 review. The decision removes an immediate risk for companies such as Strategy, which has built its balance sheet around large Bitcoin (BTC) holdings.

MSTR’s stock led gains among crypto equities in pre-market trade on Wednesday, up 4.25%. On Stocktwits, retail sentiment around the Bitcoin proxy improved to ‘extremely bullish’ from ‘bullish’ the previous day as chatter rose to ‘extremely high’ from ‘high’ levels.

Meanwhile, Bitcoin’s price fell 1.7% in the last 24 hours to around $91,700. Retail sentiment around the apex cryptocurrency on Stocktwits remained in ‘extremely bullish’ territory over the past day amid ‘high’ levels of chatter.

MSCI Delays Exclusion But Tightens the Rules

MSCI said it plans to open a broader consultation on “non-operating companies generally,” leaving the long-term treatment of DATs unresolved.

For now, DATs already included in MSCI indexes will remain, provided they meet existing eligibility requirements. However, MSCI imposed constraints. It will not increase the number of shares, foreign inclusion factor, or domestic inclusion factor for these securities. It will also defer additions or size-segment migrations.

The rules effectively freeze the index footprint of companies like MSTR. Even if they issue new equity, those shares will not be reflected in MSCI index calculations, limiting future passive inflows tied to index rebalancing.

Strategy Welcomes Outcome While Critics Push Back

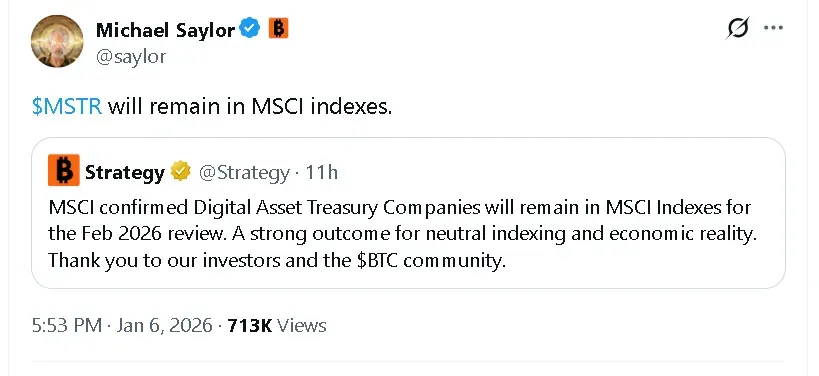

Strategy welcomed the decision, and Michael Saylor, the firm’s executive chair and former CEO, also echoed the sentiment in a post on Twitter.

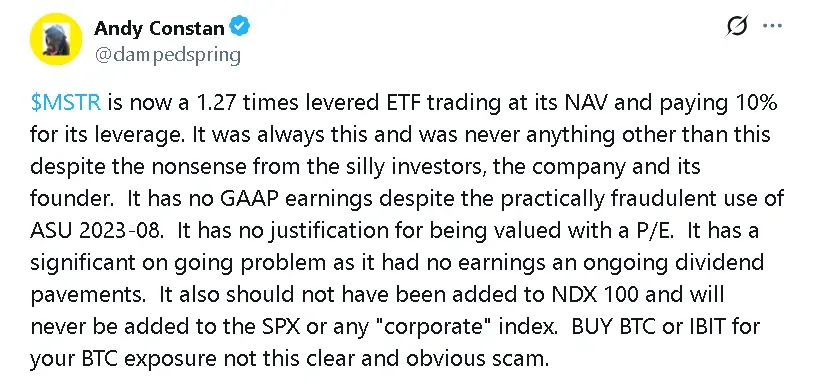

Critics, however, said the MSCI move merely postpones a broader reckoning. Crypto market watcher Andy Constan described MicroStrategy as “a 1.27 times levered ETF trading at its NAV and paying 10% for its leverage.”

Constan added that the company “has no GAAP earnings,” “has no justification for being valued with a P/E,” and “should not have been added to NDX 100 and will never be added to the SPX or any ‘corporate’ index.”

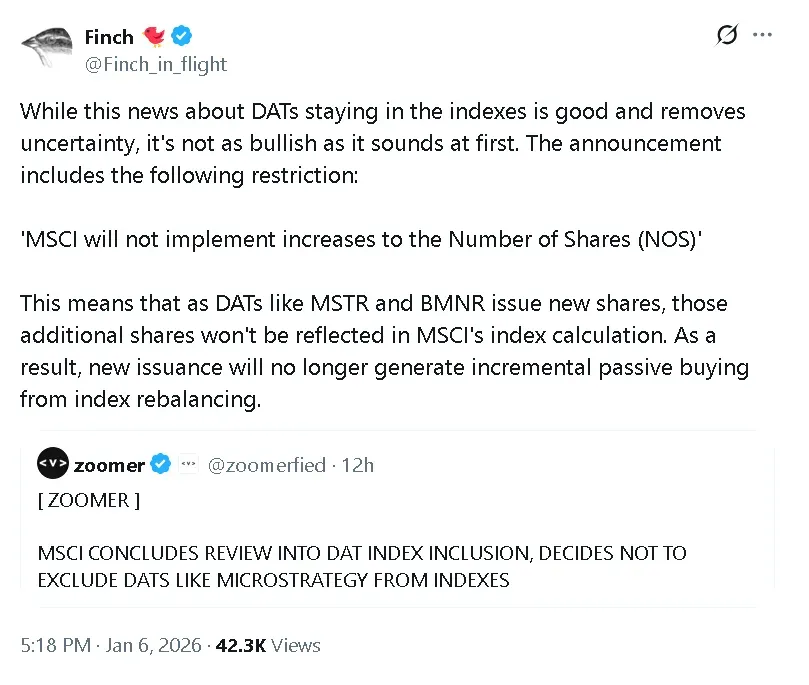

Others focused on what the MSCI restrictions mean for future demand. Crypto market watcher who goes by Finch on X said, “While this news about DATs staying in the indexes is good and removes uncertainty, it's not as bullish as it sounds at first.”

He pointed to MSCI’s decision not to implement increases to the number of shares, noting that new equity issuance by DATs such as MSTR would no longer generate incremental passive buying through index adjustments.

Attention has also turned to Strategy’s preferred equity offerings, particularly STRC. Crypto Analyst Novacula Occami pushed back against claims that these instruments function as digital credit tied to Bitcoin. “Can we please understand the basics. $STRC and the other prefs ARE NOT ‘DIGITAL CREDIT,’” he wrote in a post on X.

He added that the structure lacks key protections commonly found in preferred securities, including asset backing, maintenance covenants, and change-of-control provisions.

MSTR’s stock has gained 2% this year so far, and is down nearly 55% over the past 12 months.

Read also: Arthur Hayes Calls On Binance, Bybit To List This Crypto Token After It Hit A Record High

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Bury_resized_jpg_14e6fc7c2b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2165533708_jpg_f85d1f9870.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_teladoc_logo_resized_f3ec80cc27.jpg)