Advertisement|Remove ads.

Peter Schiff Questions Michael Saylor’s Bitcoin Debt Strategy – Says BTC Could Find ‘Support’ At $10,000

- Schiff criticized Saylor’s plan to refinance debt and continue buying Bitcoin if prices fall sharply.

- He questioned Bitcoin’s credibility if it were still trading at $8,000 in 2030.

- An ongoing Stocktwits poll showed many traders expect Bitcoin to remain below $80,000 in the near term.

- Meanwhile, the Crypto Fear & Greed Index dropped to record lows last seen during the March 2020 crash.

Peter Schiff, known for his bearish narrative around Bitcoin (BTC) and preference for gold, mocked Strategy (MSTR) executive chairman Michael Saylor on Wednesday and suggested that the next real support level for BTC could sit near $10,000.

“Looking at a long-term Bitcoin chart, it looks like it will have some initial support around $10K,” he said in a post on Twitter. Schiff also took a swipe at Saylor’s pitch to refinance its debt so that it could continue buying Bitcoin if the apex cryptocurrency’s price were to fall to $8,000.

He questioned if “anyone would still take Saylor or Bitcoin seriously” if Bitcoin were still trading at $8,000 in 2030 — a level that would represent a 94% decline from Bitcoin’s record high of over $126,000 seen in October, and roughly 60% below its 2017 high more than a decade earlier.

MSTR Stock Tracks Bitcoin’s Moves

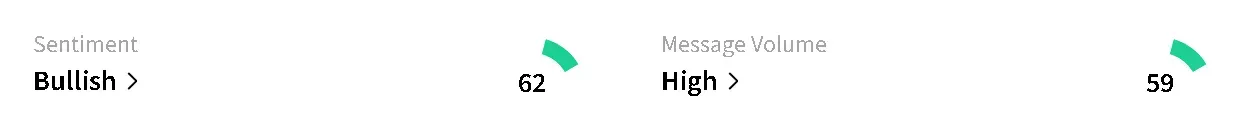

Bitcoin’s price rose 1.2% in the last 24 hours to around $67,500, with retail sentiment on Stocktwits around BTC flipping to ‘bullish’ from ‘bearish’ territory. Chatter remained at ‘high’ levels.

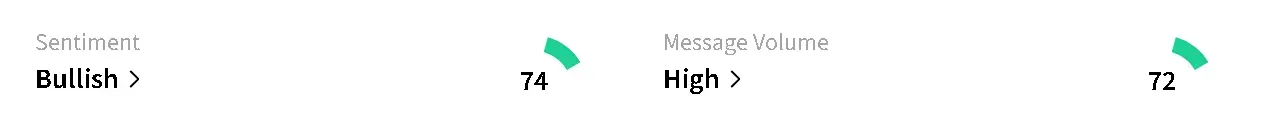

So far this year, Bitcoin’s price has plummeted nearly 23% while MSTR’s stock has dropped around 18%. The shares rose 1.21% in pre-market trading, and retail sentiment toward the company also improved, mirroring BTC’s recovery. Stocktwits data showed sentiment rising to ‘bullish’ from ‘neutral’ territory over the past day, even as chatter dipped to ‘high’ from ‘extremely high’ levels.

Retail commentary on the platform indicated that some users echoed Schiff’s view on Saylor’s plan for when Bitcoin’s price reaches $8,000.

Retail Expectations Remain Subdued

According to an ongoing Stocktwits poll, retail traders don’t expect Bitcoin’s price to climb back above $80,000 for at least the next three months. Some expect it to dip below $50,000 before any kind of recovery. The Crypto Fear & Greed Index is also trending at record lows last seen during the COVID-19 crypto crash in March 2020.

Koyfin data shows Wall Street currently has an average price target of over $402 for MSTR’s stock, with 13 out of 24 analysts giving it a ‘Buy’ or ‘Strong Buy’ rating. That represents a potential upside of 219% from Wednesday’s close.

Read also: BERA Crypto Token Doubles In A Week Defying Bitcoin Weakness – And It’s Not A Meme Coin

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ford_jpg_186fb0eaa9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2237643016_jpg_17a9a7eb9d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221557373_jpg_2cb3ed82cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bulls_versus_bears_stock_market_jpg_c083ddc168.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2251311021_jpg_31a407e714.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_aluminum_resized_jpg_6efa759339.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)