Advertisement|Remove ads.

Crypto Fear And Greed Index Dips To Record Lows Last Seen During COVID Crash

- Market sentiment around cryptocurrencies has remained in ‘Extreme Fear’ territory throughout February.

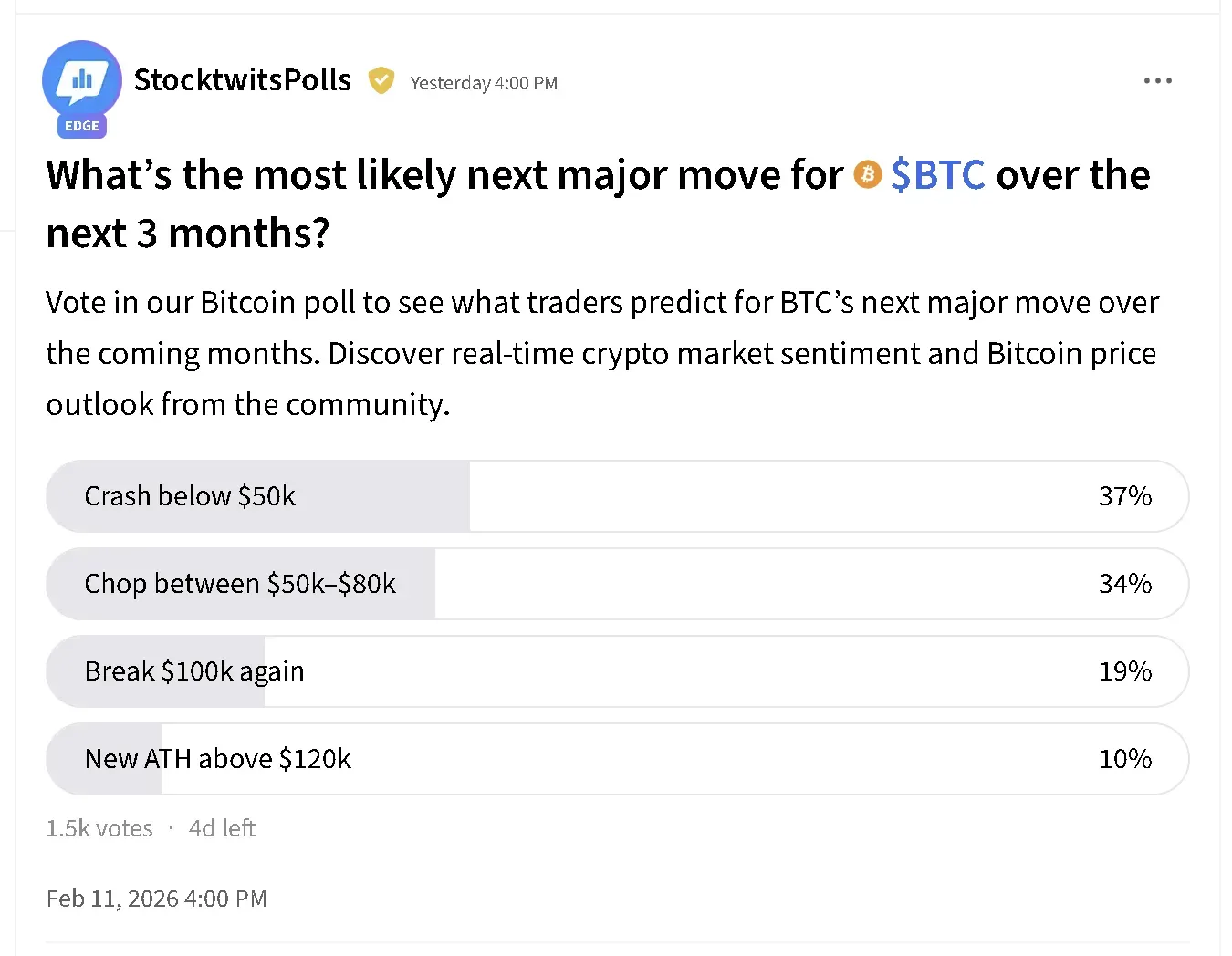

- An ongoing Stocktwits poll showed the majority of retail traders expect Bitcoin to fall below $50,000 or remain range-bound over the next three months.

- The altcoin market has fallen around 21% in 2026, with Ethereum accounting for a bulk of the decline.

The Crypto Fear and Greed Index dipped to record lows on Thursday, last seen during the COVID-19 crash in March 2020.

According to data on alternative.me, market sentiment around cryptocurrency has been drifting in the ‘Extreme Fear’ territory all through February, consistently below the 20-mark. On Thursday morning, it fell by more than 50% to a reading of 5, from 11 during the previous session.

During the March 2020 COVID crypto crash, known as "Black Thursday," Bitcoin’s price dropped over 50% in hours amid global pandemic panic. The Crypto Fear and Freed Index read between 3 to 5.

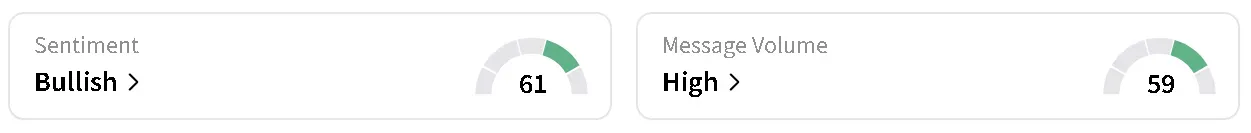

On Thursday morning, however, BTC’s price climbed back over the $67,000, edging higher by 0.8% in the last 24 hours, but that doesn’t seem to have assuaged market fears. On Stocktwits retail sentiment told a different story, with data around Bitcoin flipping to ‘bullish’ from ‘bearish’ over the past day. Chatter remained at ‘high’ levels.

Traders Are Bracing For Bitcoin’s Price To Pullback Further

Despite the turn in retail sentiment, an ongoing poll on the platform showed that most respondents believe that Bitcoin’s price is likely to crash below $50,000 in the next three months, followed by users who think trading the cryptocurrency will remain choppy between the $50,000 to $80,000 range.

Only 19% forecast that Bitcoin’s price will climb back above 19%, with only 10% anticipating that the apex cryptocurrency will be able to set a new all-time high.

Altcoins Under Pressure In 2026

The overall cryptocurrency market capitalization rose 1.3% in the last 24 hours to $2.38 trillion, but has fallen over 25% this year. Even after taking Bitcoin’s price dip of 22% out of the equation, the altcoin market value is down around 21% in 2026.

However, excluding Ethereum (ETH), the year-over-year drop is around 15%. The altcoin is down over 33% this year. Ethereum’s price is currently trading below the $2,000 mark, with traders watching for a recovery or for the downtrend to deepen and hopefully find a bottom soon.

According to Bitmine Immersion Technologies (BMNR) chairman Tom Lee, the leading altcoin is likely to show a V-shaped recovery with the ‘perfect bottom’ forming at $1,890. BMNR’s stock has been dropping alongside the dip in Ethereum. The shares are down over 30% so far this year.

Read also: BERA Crypto Token Doubles In A Week Defying Bitcoin Weakness – And It’s Not A Meme Coin

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_natural_gas_plant_resized_jpg_e43db2dc7b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_JP_Morgan_JPM_resized_jpg_5def7e91d0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240044381_jpg_d366402b12.webp)