Advertisement|Remove ads.

Popular Risk Trader James Wynn Says His ‘Comeback Will Be Violent’

- After a $100 million loss earlier this year, risk trader James Wynn declared his “comeback will be violent” after establishing a 40x leveraged long on Bitcoin.

- Wynn held a 10x leveraged long in Pepe (PEPE), which rose more than 17% in 24 hours and generated over $530,000 in unrealized profit, according to OnchainLens data.

- Wynn's renewed stance is keenly scrutinized because of his history of huge, obvious losses on his Hyperliquid trade.

Risk trader James Wynn said on Sunday that his “comeback will be violent” after opening a leveraged long position on Bitcoin (BTC).

In the X post, James Wynn announces a "violent" return to high-leverage trading, citing on-chain data indicating a 40x Bitcoin long and a lucrative 10x Pepe position on Hyperliquid (HYPE). The “comeback” comment referred to his return to a previous Hyperliquid trade where he lost $100 million.

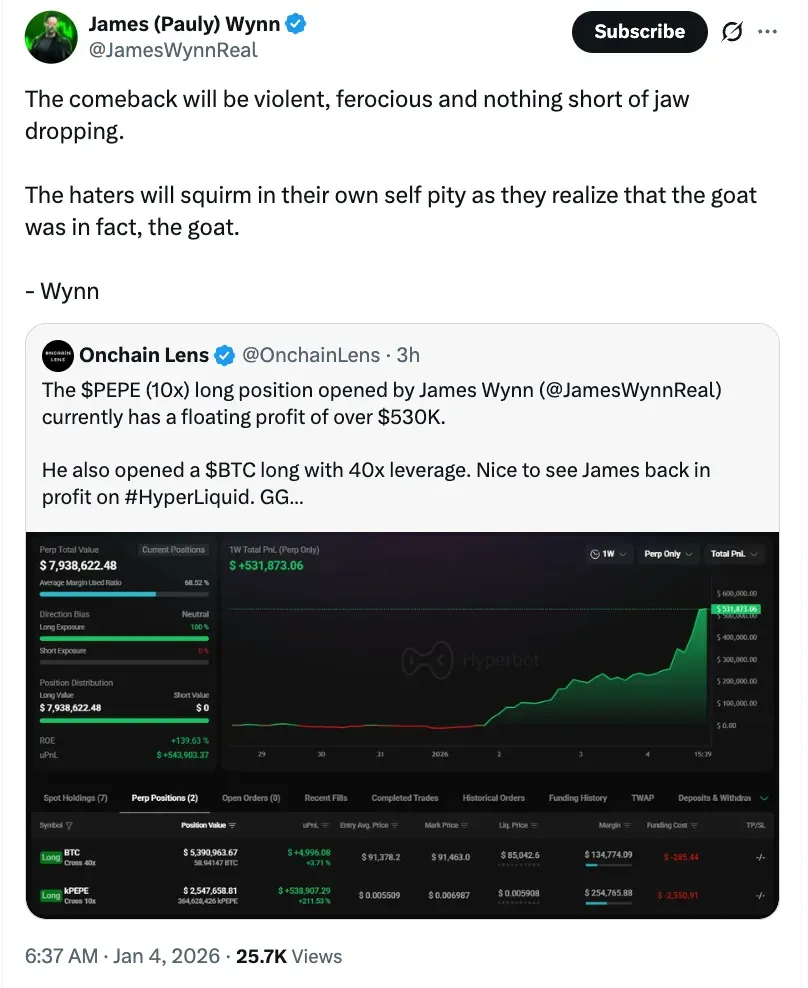

James Wynn responded to blockchain analytics firm OnchainLens on X, which showed that he had opened a leveraged long position in Bitcoin. The post also showed Wynn holding a large long position in the memecoin Pepe (PEPE), which was showing a floating profit of more than $530,000. Screenshots shared by OnchainLens showed Wynn’s positions, with unrealized gains concentrated in the PEPE trade.

Pepe (PEPE) was trading at $0.000007010, up 17.4% over the past 24 hours. On Stocktwits, retail sentiment around Pepe remained in ‘extremely bullish’ territory, accompanied by ‘extremely high’ levels of chatter, over the past day.

OnchainLens reported that Wynn opened a Bitcoin long with 40x leverage on the Hyperliquid derivatives platform. The analytics firm also noted that Wynn holds a 10x leveraged long position in PEPE.

Wynn’s Previous Losses Amounted To $100 Million

Wynn is a high-risk crypto derivatives trader known for using significant leverage. In May 2025, Wynn lost roughly $100 million trading on the Hyperliquid platform, including both profits and principal, after a series of leveraged positions moved against him, according to DL News. Wynn continued trading following those losses and has remained active in high-leverage markets, drawing attention due to the size and visibility of his positions.

Hyperliquid (HYPE) was trading at $25.18, up 2.42% over the past day. On Stocktwits, retail sentiment around Hyperliquid changed from ‘bearish’ to ‘neutral’ territory, accompanied by ‘normal’ chatter levels over the past day.

Read also: Coinbase Exits Argentina Despite It Surpassing Brazil In Crypto Adoption

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)