Advertisement|Remove ads.

Ripple Reportedly Doubles Down On Digital Asset Treasury Plans, Marking Its Late Entry Into The Growing Sector

Ripple is accelerating its digital asset treasury (DAT) strategy, reportedly aiming to raise at least $1 billion to expand its holdings of its native token XRP (XRP).

According to a Bloomberg report, the fundraising is expected to be executed via a special purpose acquisition company, with Ripple contributing a portion of its existing XRP holdings. The funds will reportedly be housed inside a new digital asset treasury (DAT). Bloomberg added that details of the transaction and structure remain under discussion and could change.

Ripple’s reported initiative follows its $1 billion acquisition of GTreasury on Thursday. The deal positions Ripple to expand its footprint in the multi-trillion-dollar corporate treasury sector. Its move to deepen its presence in the digital asset treasury (DAT) space comes as more companies have pivoted to DATs amid the Trump administration’s increasingly crypto-friendly stance this year.

However, the company’s entry into the sector comes after the initial wave of enthusiasm had already peaked. U.S. regulators, including the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (Finra), are reportedly looking at companies that have shown high share price volatility amid their pivots to a crypto treasury strategy.

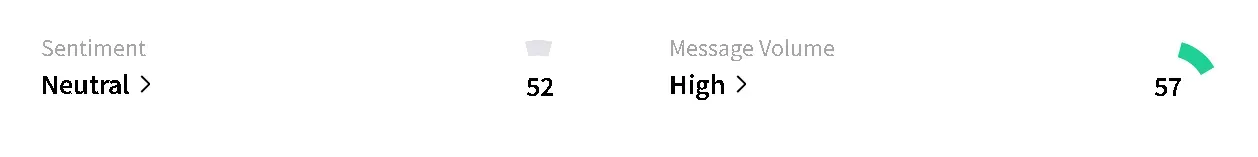

Ripple’s native token XRP (XRP) fell 1.9% in the last 24 hours, according to CoinGecko. XRP’s price was trading at around $2.31, with retail sentiment on Stocktwits dipping to ‘neutral’ from ‘bullish’ territory amid ‘high’ levels of chatter.

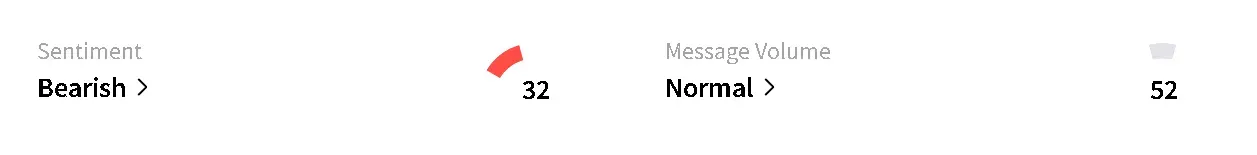

Retail sentiment around Ripple’s stablecoin (RLUSD) was in ‘bearish’ territory, accompanied by ‘normal’ levels of message volume.

One bullish trader said they’re looking forward to XRP’s price dipping to $2.

Another trader opined that the token’s price is most likely to rise again once the U.S. government shutdown comes to an end.

The token has been struggling to recover since last week’s sell-off triggered by President Donald Trump’s 100% tariff threat to China. Rising trade tension between the two nations this week continued to weigh on the market alongside growing concerns over the stability of the U.S. regional banking sector. XRP has fallen more than 17% in the last seven days, and is trading over 37% below its all-time high of $3.65, seen in July.

Read also: Bitcoin Falls Below $105,000, Pulling MSTR Lower – XRP And Solana Drop Amid Banking Jitters

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Ui_Path_resized_210dc0332c.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_006db9f466.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tesla_jpg_2554310f4f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_solaredge_technologies_resized_56b964ed87.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_aldyera_jpg_04cdfd0201.webp)