Advertisement|Remove ads.

SEC Slashes Haircut On Payment Stablecoins To 2% In Bid To Boost Adoption

- The change allows broker-dealers to hold stablecoins such as USDC and USD1 without significantly impacting capital ratios.

- Previously, the 100% haircut made stablecoin custody and settlement economically unattractive for regulated firms.

- The move aligns with the 2025 GENIUS Act, which established reserve and oversight standards for issuers.

The U.S. Securities and Exchange Commission (SEC) has reduced the capital charge for broker-dealers holding certain “payment stablecoins,” like USDC (USDC) and USD One (USD1) by lowering the required haircut to 2% from 100%.

“The staff would not object if a broker-dealer were to apply a 2% haircut on proprietary positions in a payment stablecoin when calculating its net capital.”

– Hester M. Peirce, Commissioner, Securities and Exchange Commission

Simply put, financial firms are supposed to keep a liquid cash buffer to protect customers if they fail, which mean that riskier assets get ‘haircuts’. This implies a reduction in their value while they’re on the balance.

Until now stablecoins faced a 100% haircut, which meant holding them was worthless. It kept banks and other traditional players from using stablecoins for crypto trading and settlements. With the haircut now down to 2%, the treatment of stablecoins now matches the treatment of safe money market funds.

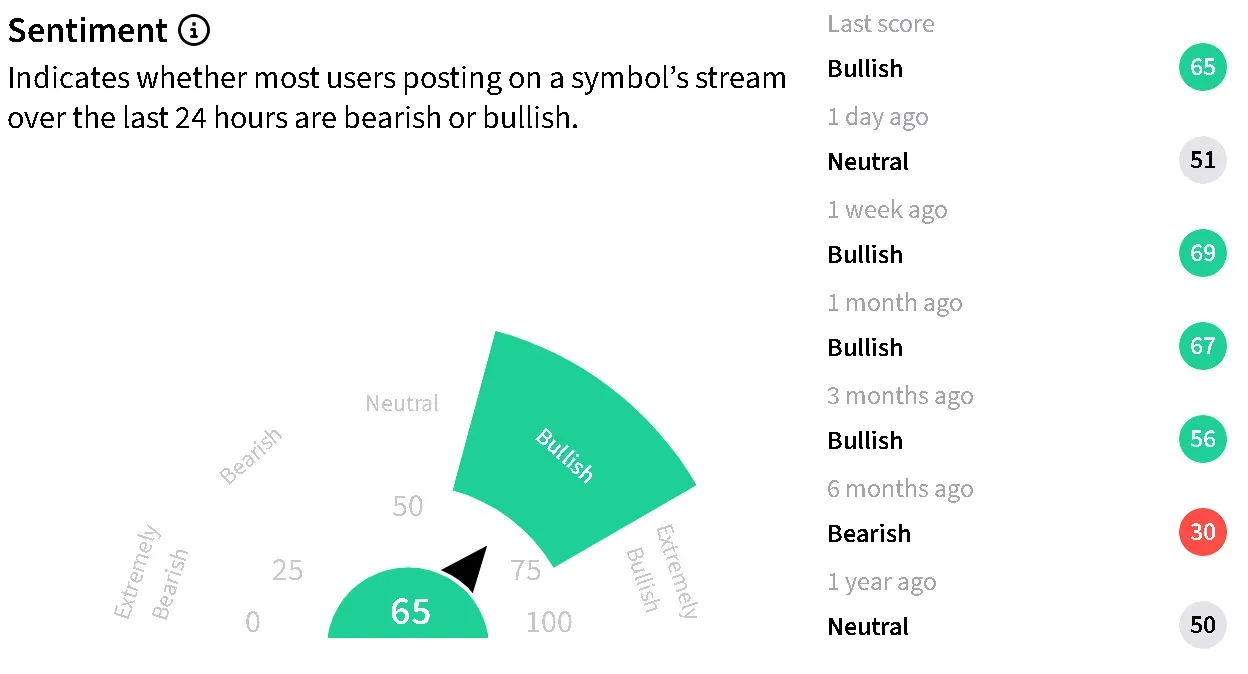

Retail Sentiment Mixed

On Stocktwits, retail sentiment around World Liberty Financial's (WLFI) USD One improved to ‘bullish’ from ‘neutral’ over the past day. However, retail sentiment around two of the biggest stablecoins in the market, USDC and Tether (USDT) remained in ‘bearish’ territory.

What Does This Mean For Crypto Adoption?

The haircut reduction is meaningful implementation of the the GENIUS Act, which passed last year and promised clearer regulatory guidelines. The move also reflects another crypto-friendly move by the agency under President Donald Trump’s agenda of pushing the U.S. to lead when its comes to the cryptocurrency market.

For banks and other financial players, lower capital charges make it less expensive to use stablecoins. That could support growth in tokenized securities, on-chain trading platforms and blockchain-based settlement systems.

For end users, the change could translate into more regulated stablecoin services offered by banks and mainstream financial institutions. The rule also bodes well for the CLARITY Act, which is currently under discussion in Washington after being stalled in January.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_iran_blasts_original_june_23_jpg_1f32635e90.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paul_atkins_OG_2_jpg_fe323fca3c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1238682609_jpg_1eaa8b086d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1234974378_jpg_77779a942b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_witt_OG_jpg_0aafea4585.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147543_jpg_a7d6168b5c.webp)