Advertisement|Remove ads.

Solana Sinks As Token Unlock, Meme Coin Fallout Fuel Sell-Off: Retail’s Buying The Dip

Solana (SOL.X) tumbled more than 8.5% on Sunday, underperforming major cryptocurrencies as investors ramped up short positions ahead of the looming token unlock that could introduce billions of dollars in supply.

According to Glassnode data, open interest for SOL has reportedly risen by 40% in 48 hours, while funding rates are increasingly gravitating toward negative territory.

The volatility made Solana the second-most trending ticker on Stocktwits during pre-market U.S. trading hours.

The sell-off came after the controversial launch of the Libra (LIBRA) meme coin, which saw 95% of its market capitalization erode within hours, wiping out $4.4 billion on Feb. 14.

The turmoil deepened amid legal scrutiny of Argentine President Javier Milei, who faces allegations of misleading promotion related to the Libra token.

Adding to Solana’s headwinds, the blockchain faces a looming token unlock that could introduce billions of dollars in supply.

Over the next three months, more than 15 million SOL tokens — worth approximately $3 billion — are set to be released, raising fears of increased selling pressure.

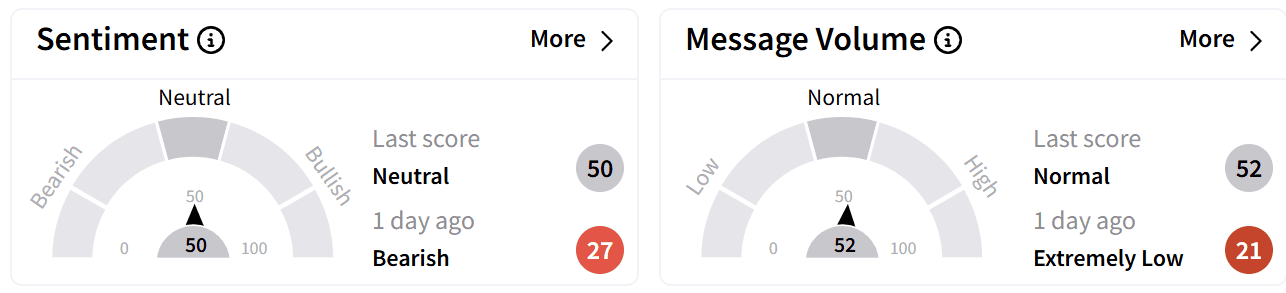

On Stocktwits, retail sentiment around Solana improved to ‘neutral’ from ‘bearish’ a day ago, and chatter picked up to ‘normal’ levels.

One user forecasted that there would be more pain.

Many others are buying the dip amid the price crash.

Following SOL, leading Solana ecosystem tokens — including JUP, RAY, JTO, SOS, and others — have declined over 10% in the past 24 hours.

The network has seen a wave of speculative tokens lose nearly all their value post-launch, raising concerns over its long-term viability as a hub for digital asset speculation.

The Libra debacle—widely criticized as a “rug pull”—is the latest in a string of high-profile meme coin failures on Solana.

The Official Trump (TRUMP) token, another Solana-based meme coin, reportedly caused an estimated $2 billion in losses across 800,000 wallets.

While previous memecoin successes such as Bonk (BONK) and Dogwifhat (WIF) helped Solana’s ecosystem surpass $4 billion in market cap, those short-lived gains have largely evaporated.

Despite recent losses, Solana remains up 50% year-over-year.

However, its token price has slumped 40.9% over the past month and is now trading 42% below its all-time high of $293.31, reached on Jan. 19 ahead of President Donald Trump’s inauguration.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Broadcom, Qualcomm Or Apple? Retail Investors Split On Who Gains As Skyworks Loses iPhone Business

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)