Advertisement|Remove ads.

Sui Token Rallies After Trump-Linked World Liberty Financial Announces ‘Strategic Reserve Deal’ – Retail Turns Bullish

The native token of Sui (SUI) jumped nearly 20% on Thursday after Trump-affiliated decentralized finance (DeFi) protocol World Liberty Financial (WLFI) announced a “strategic reserve deal” with the layer-1 blockchain project.

As part of the agreement, WLFI will add Sui assets to its ‘Macro Strategy’ token reserve and explore potential product development opportunities with the blockchain.

SUI spiked to nearly $3.25 before paring gains, marking the biggest jump among the top 20 cryptocurrencies by market capitalization, according to CoinGecko data.

“Given our plans to support foundational DeFi assets in the coming months, collaborating with Sui was an obvious decision,” said WLFI co-founder Zak Folkman.

The move follows Eric Trump’s disclosure in January that Sui was part of his portfolio. Trump, who serves as WLFI’s Web3 Ambassador, has been vocal about the protocol’s ambitions in the crypto space.

WLFI’s $336 million portfolio remains heavily concentrated in Ethereum (ETH), which accounts for 60.4% of holdings, followed by Wrapped Bitcoin (wBTC) at 29%.

The remaining allocations include Tron (TRX) at 3%, Movement (MOVE) at 2%, AAVE at 2%, Chainlink (LINK) at 2%, and Ethena (ENA) at 1%.

Despite the announcement, WLFI’s portfolio has taken a hit, down 9% in the last 24 hours and about 36% from its peak, according to Arkham data.

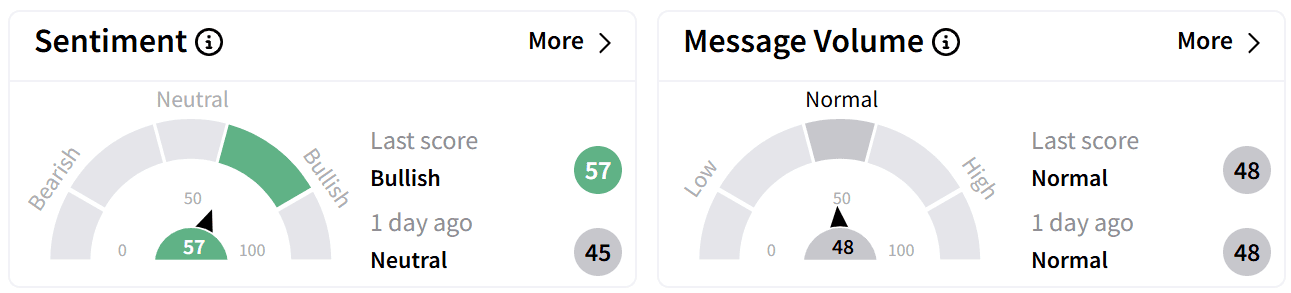

Retail sentiment on Stocktwits around SUI’s token surged to ‘bullish’ from ‘neutral’ a day ago.

One user speculated that a major rally could follow the announcement.

Another expressed surprise that SUI didn’t climb higher.

Even with Thursday’s rally, SUI remains 44% below its all-time high of over $5, reached on Jan. 5. However, the token has more than doubled in value over the past year.

The broader crypto market has been undergoing a correction since its November 2024 rally.

Bitcoin (BTC) has pulled back from its all-time high of $109,000 to around $91,000, weighing heavily on altcoins like SUI, which saw explosive growth in late 2024, and has fallen 44% over the past 60 days.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)