Advertisement|Remove ads.

Supreme Court Blocks Trump’s Tariffs, Tom Lee Thinks It Could Be Bitcoin’s Next Bullish Trigger

- Limiting tariff powers might make policies less uncertain, ease inflation, and give Bitcoin a chance to go up again before the end of the year, according to Tom Lee.

- The ruling limits the broad tariff authority, but the White House's pushback keeps the policy risk high in the short term.

- In the past, tariff increases caused big drops in crypto and stock prices, showing that trade policy is a major risk factor.

Fundstrat co-founder Tom Lee said Supreme Court hearings on the administration’s tariff powers could be a positive catalyst for crypto, arguing that limiting tariffs could reduce uncertainty and support risk assets.

In an interview with CNBC on Friday, Lee said investors seemed relieved that the Court may place limits on broad executive tariff authority. He said once markets move past the tariff agenda, attention could return to cooling inflation, softer labor data, and the prospect of Federal Reserve rate cuts.

“With positive Washington tailwinds, I think Bitcoin can do well to the end of the year,” Lee said, adding that Bitcoin reaching $150,000 or higher remains possible even though sentiment feels weak.

Lee said recent market weakness has been largely driven by uncertainty over trade policy. He explained that tariffs can push inflation higher and make it harder for the Fed to cut rates. If the court limits tariffs, inflation pressure could ease, giving the Fed more room to lower rates and improving conditions for risk assets like Bitcoin (BTC).

Lee also added that the Court’s involvement could reduce one of the biggest sources of policy uncertainty facing markets. He argued that clarity around trade policy may allow investors to focus again on inflation trends and rate expectations rather than headline risk.

Supreme Court Blocks Trump Tariffs But White House Pushes Back

On Friday, the Supreme Court dealt a big blow to President Donald Trump by saying that he went too far when he used a law meant for national emergencies to impose wide-ranging tariffs.

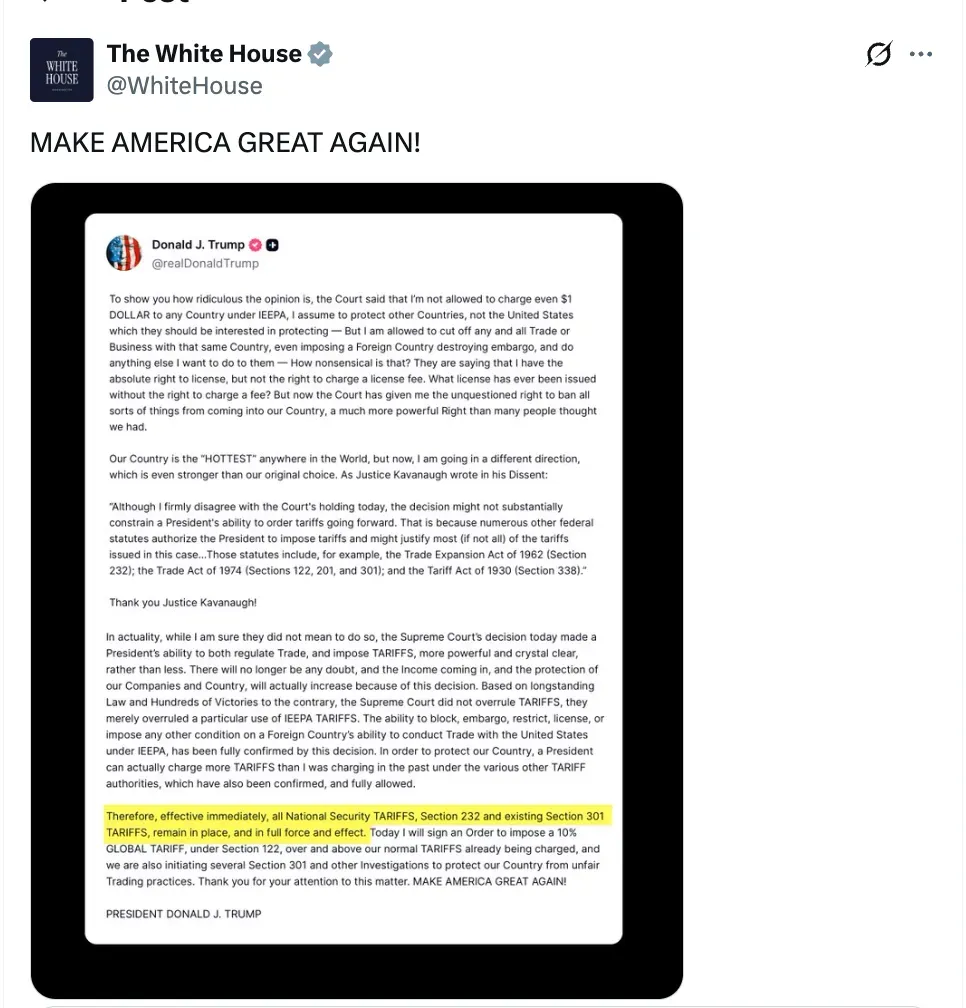

The White House, on the other hand, said again that "Nothing changes, they will be paying tariffs," which goes against the ruling from Friday. According to the Kobessi Letter, the government is expected to pay American citizens back over $150 billion.

Bitcoin (BTC) traded at $67,752.24, flat in the last 24 hours. On Stocktwits, the retail sentiment remained in ‘bearish’ territory, with chatter at ‘low’ levels over the past day.

In October last year, when Trump imposed a 100% tariff hike on China, the crypto market saw over $19 billion in liquidation, as per Coinglass data. Paul Barron stated that the uncertainty quickly spilled into financial markets. He noted that the S&P 500 had fallen 10.5% from its 2025 highs, marking a sharp drawdown.

Supreme Court Ruling Sparks Stock Market Bounce

The US stock market went up shortly after the Supreme Court ruled against Trump's 'unlawful' tariffs. The S&P 500 shot up by almost 0.7%, and the Dow Jones Industrial Average went up by about 0.5%. The Nasdaq Composite, which heavily tracks tech stocks, led the way with a gain of almost 0.9%.

According to Coinbase Institutional, Bitcoin is also moving like a software technology stock. On Friday, Coinbase shared that Bitcoin’s 90-day rolling correlation with the iShares Tech-Software ETF (IGV) has remained higher than usual but noted that this link may not last and could change quickly if market conditions shift. In the last 24 hours, Bitcoin has seen over $7 million in leveraged flush.

Read also: Scaramucci Calls Banks ‘Cab Companies’, Frames Coinbase And Tether As ‘Uber’

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)