Advertisement|Remove ads.

Tether CEO Confirms Targeting Up To $20B Fundraise, Valuation Could Rival OpenAI

Tether, the issuer of the world’s largest stablecoin USDT, is exploring a major fundraising round that could value the company on par with leading AI firm OpenAI, CEO Paolo Ardoino confirmed.

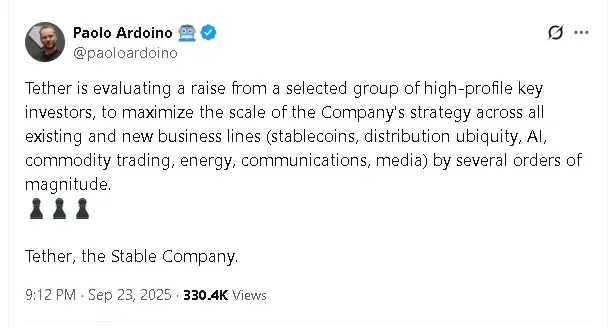

According to a report by Bloomberg, the company is targeting $15 billion to $20 billion for a roughly 3% stake through a private placement. Ardoino confirmed the fundraising plans in a post on X, saying the round targets “a selected group of high-profile investors to scale the Company’s strategy across all existing and new business lines—stablecoins, distribution, AI, commodity trading, energy, communications, and media—by several orders of magnitude.”

Despite news of fresh funding, retail sentiment on Stocktwits around USDT dipped to ‘bearish’ from ‘neutral’ territory over the past day.

OpenAI’s current valuation is reportedly around $500 billion, making it the world’s most valuable private company—surpassing SpaceX, TikTok’s parent company ByteDance, and even public firms like Palantir. If Tether’s fundraising round reaches its $15 billion to $20 billion target, it could place the crypto giant on a comparable footing to OpenAI.

The firm’s leadership also has notable financial and political ties. Tether has relied on Cantor Fitzgerald as its primary custodian for U.S. Treasury reserves since 2021, eventually managing nearly 99% of the company’s $130 billion reserves. U.S. Commerce Secretary Howard Lutnick was the CEO of Cantor Fitzgerald, and his son Brandon Lutnick now serves as chairman and CEO.

Tether also recently announced a new U.S.-focused stablecoin, USAT, and named former White House advisor Bo Hines as its CEO. Hines, who previously led the Presidential Council of Advisors for Digital Assets within the Trump administration, was named CEO of Tether U.S.

Tether’s USDT, the world’s largest stablecoin with a $173 billion market cap, has faced scrutiny over its reserve backing. While Tether now reports mainly holding U.S. Treasuries and publishes quarterly attestations, it has yet to complete a full independent audit, unlike rivals such as Circle’s (CRCL) USDC (USDC).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Deere_resized_a913c16f0a.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_b2gold_jpg_2d344842dd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_whitehouse_OG_jpg_2cc16854dc.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_OG_jpg_3ac8291bf2.webp)