Advertisement|Remove ads.

The $8 Trillion Signal: How Ethereum Is Becoming Crypto’s Financial Backbone

- Mike Silagadze, the CEO of ether.fi said that Ethereum’s growth will center on user-facing financial products as neobanks expand stablecoin services.

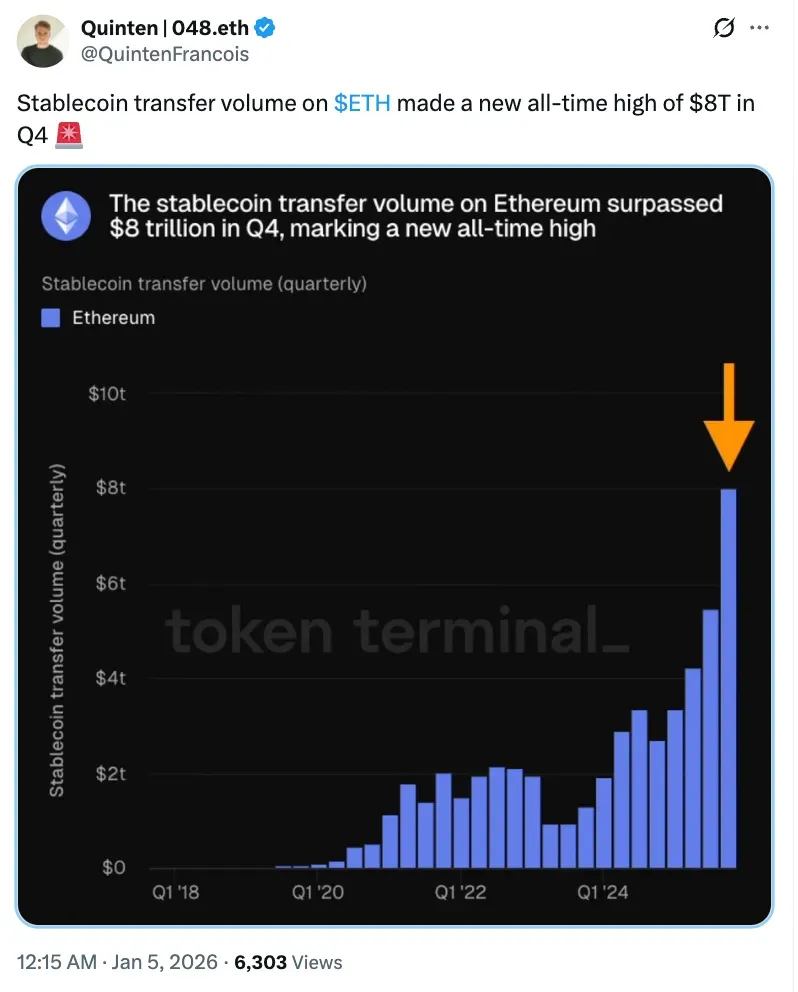

- Token Terminal’s data showed that stablecoin transfer volume on Ethereum topped $8 trillion in Q4.

- Tether leads the Ethereum stablecoin supply with about $103 billion.

The Ethereum (ETH) blockchain is on track for exponential growth, as neobanks are choosing it as their infrastructural backbone, said Mike Silagadze. This comes at a time when Ethereum’s stablecoin value surpassed $8 trillion (in the fourth quarter) as of Monday.

Speaking to Coindesk, Silagadze, the CEO of restaking platform ether.fi, said that Ethereum’s next phase of growth would be driven by user-facing financial products rather than speculative trading. Silagadze believes this shift will coincide with growing attention on crypto-native neobanks, which are increasingly integrating stablecoins into consumer-facing products such as payments, savings, and remittances.

Ethereum (ETH) was trading at $3,178, up by 1.3% in 24 hours. On Stocktwits, retail sentiment around Ethereum remained in the ‘neutral’ zone, accompanied by ‘normal’ chatter levels over the past day.

Ethereum’s Stablecoin Transfer Value Reaches New High

On Monday, Token Terminal announced on X that stablecoin transfer volume on Ethereum surpassed $8 trillion in Q4, marking the highest quarterly level on record.

The record transfer volume reflects increased on-chain movement of dollar-pegged stablecoins on the Ethereum network during the quarter.

Tether Dominates Stablecoin Supply On Ethereum

According to the Token Terminal’s stablecoin supply dashboard, Tether (USDT) holds the largest stablecoin supply on Ethereum, approximately $103 billion in stablecoins issued on the network.

Circle’s USD Coin (USDC) ranks second with around $51.8 billion, followed by Sky (SKY) at roughly $10.1 billion and Ethena (ENA) with about $7.1 billion. PayPal’s stablecoin PYUSD represents approximately $2.7 billion in Ethereum-based stablecoins, while Paxos-issued stablecoins total around $1.7 billion.

Read also: A New Crypto Wallet Is Wagering Big On A China–Taiwan Conflict

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019709_jpg_f82a27a246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1005541622_jpg_8079d8d434.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)