Advertisement|Remove ads.

BTC, ETH, XRP Crash Wipes Out January Gains After Tariff Shock: Retail Lashes Out At Trump

Crypto majors Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) continued their downward slide ahead of U.S. market hours on Monday, following President Donald Trump’s announcement of new tariffs on Canada, Mexico, and China last Friday.

Over the weekend, these digital assets erased most of their January gains as traders increasingly opted to dump positions in risk assets amid an unfolding trade war.

The Grayscale Bitcoin Mini Trust (BTC) fell over 6% in pre-market trading on Wednesday, reflecting Bitcoin's reversal.

Bitcoin, which had surged to an all-time high of $108,786 shortly before Trump's inauguration, was trading 13% below that level at $95,277 in early trading, according to CoinGecko.

The sell-off triggered significant liquidations in the crypto market, with 729,560 traders liquidated over the past 24 hours, totaling $2.27 billion in liquidations, as per CoinGlass data.

Retail investors expressed concerns that the tariffs could fuel global inflation, complicating efforts by central banks, including the U.S. Federal Reserve, to cut interest rates.

The Grayscale Bitcoin Mini Trust (BTC) was down over 6% in pre-market trade on Wednesday as Bitcoin reversed most of its January gains.

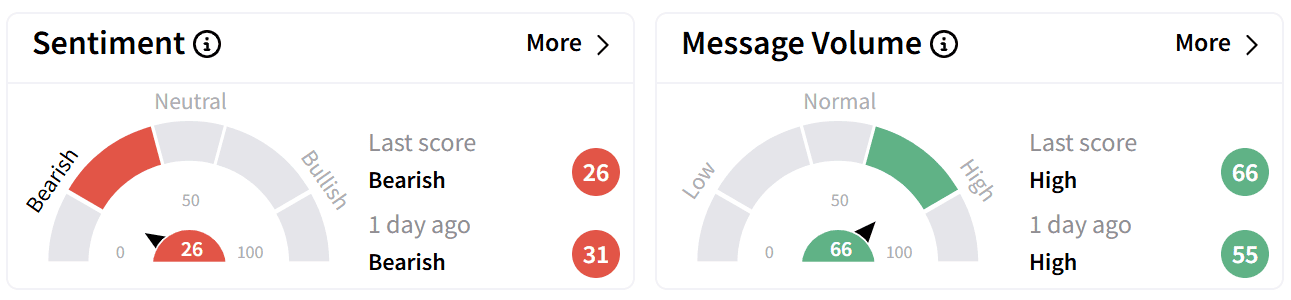

On Stocktwits, retail sentiment around Bitcoin fell deeper into the ‘bearish’ territory as chatter remained ‘high’ as investors voiced frustration over the tariffs' ripple effects on crypto.

Some anticipate further declines once U.S. markets open.

Bitcoin’s value more than doubled over the past year. Retail investors were hoping for more gains after Trump pro-crypto stand during his campaign. However, the apex crypto is only up 1.64% for the year.

Ethereum took the hardest hit among the top 10 cryptocurrencies, falling over 14% in the last 24 hours to $2,600 from $3,200 on Friday — marking its lowest level since November.

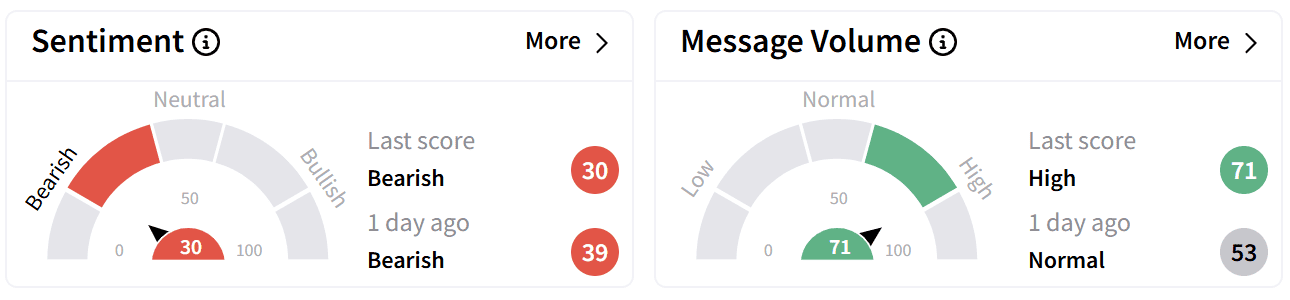

On Stockwits, retail sentiment remained ‘bearish’ as chatter increased to ‘high’ levels.

Users expressed their angst against the sell-off across altcoins especially since market commentary suggested that “altseason” was supposed to kick in late January.

Altcoin season, or “altseason”, is the time when altcoins outperform Bitcoin, both in price growth and market dominance.

Others expressed their displeasure with Trump’s new tariffs.

Over the weekend, ETH slipped more than 23% to $2,119, wiping out all of its January gains.

XRP, which facilitates transactions on Ripple Labs' digital payments platform, slumped nearly 13% to $2.40, down from over $3 on Friday.

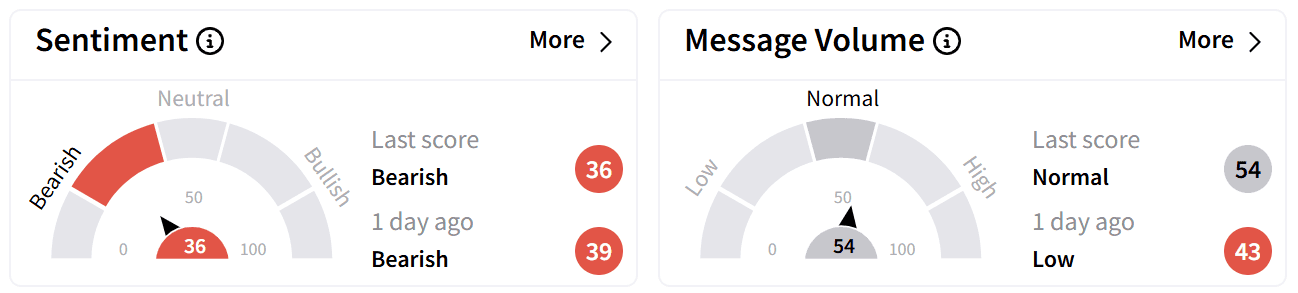

Stocktwits data showed ‘bearish’ sentiment, although chatter increased from ‘low’ to ‘normal’ levels.

Some users suggested buying the dip, while others warned there is “more pain to come.”

The token hit a weekend low of $1.76, last seen in November.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Trump Tariff Announcement Applies Emergency Brakes On Bitcoin Rally: Retail Turns Bearish

/filters:format(webp)https://news.stocktwits-cdn.com/large_blue_owl_capital_jpg_4d9954c2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553061_jpg_699278f844.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trump_media_and_technology_group_media_009b60f8cd.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HP_corporate_logo_resized_a2479d3136.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_terawulf_OG_jpg_a87a18705d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)