Advertisement|Remove ads.

Veteran Trader Warns US Dollar Index Is At A Make-Or-Break Level For Bitcoin

- The U.S. Dollar Index fell 0.82% to its lowest level since September 2025, marking its weakest January performance since 2017.

- Traders flagged the dollar at a long-term support zone that has historically aligned with major turning points in the Bitcoin and crypto markets.

- Bitcoin traded near $86,700 after briefly dipping to $85,500, as macro factors such as Fed rate expectations and gold's strength returned to the forefront.

A weakening dollar and shifting Fed rate expectations are reviving a familiar macro setup for Bitcoin. However, data from Stocktwits shows that retail traders are growing more pessimistic, even as macro conditions tilt in favor of risk assets.

The U.S. Dollar Index (DXY) slid to its lowest level since September 2025 on Friday, sliding 0.82%. According to market data shared by veteran trader Matthew Dixon on X, the dollar’s decline brought it back to a multi-decade trendline that has remained intact since the 2008 financial crisis. Dixon said the level has historically coincided with major shifts in risk sentiment, including inflection points for Bitcoin and broader crypto markets.

Bitcoin (BTC) was trading at $87,538, down by 0.8% over 24 hours. On Stocktwits, retail sentiment around Bitcoin dipped from ‘bearish’ to ‘extremely bearish’ territory, accompanied by chatter improving from ‘normal’ to ‘high’ levels over the past day.

Dollar Slides As Rate-Cut Bets Build

DXY, tracked by ICE’s U.S. Dollar Index, extended January losses as traders reassessed the U.S. rate edge and the outlook for Fed easing. Softer inflation readings and early signs of cooling growth have strengthened the case for rate cuts, narrowing the yield gap that has supported the dollar for much of the past two years.

A weaker dollar can be supportive of risk assets by loosening global financial conditions, while also pushing commodity prices higher and raising import inflation pressures. Gold was also in focus alongside the dollar move, with traders watching benchmark pricing.

Traders Remain Cautious

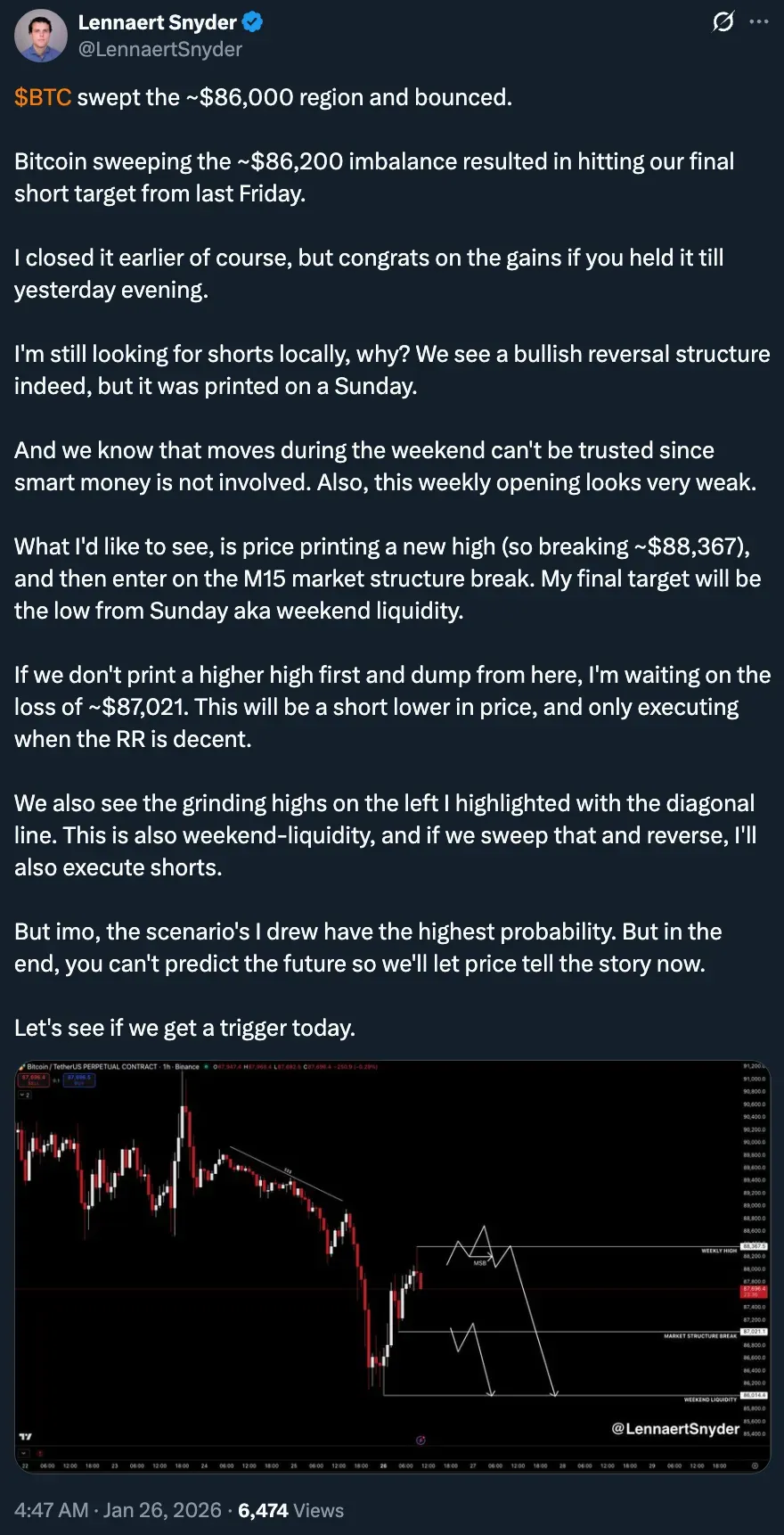

Some traders are still unsure whether Bitcoin's bounce from the $85,500–$86,000 zone will last. Lennart Snyder, a crypto market analyst, said that Bitcoin "swept the $86,000 region and bounced," but warned that the rally occurred over the weekend, when liquidity is lower and institutional investors are less active.

Snyder said on X that users can't trust moves on the weekend because smart money isn't involved. He also added that the weekly open "looks very weak" and that he is still on the lookout for more short setups unless Bitcoin makes a higher high above about $88,367.

While macro factors like a weakening dollar may provide structural support, short-term price movements remain weak and highly dependent on cash availability.

Dollar Reserves And Global Allocation Trends

Bloomberg Intelligence data shared by economist André Dragosch showed the U.S. dollar’s share of global foreign-exchange reserves falling toward 40% by late 2025, continuing a multi-decade decline.

Dragosch noted that the DXY has historically tracked changes in the dollar’s share of reserves, suggesting sustained depreciation pressure if diversification trends persist.

Read also: Could XRP Overtake Bitcoin? Traders Split As BTC Struggles Near $86,000

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)