Advertisement|Remove ads.

Tokenized Trading Is Coming To NYSE And Chainlink’s Role May Take Time To Surface, Analyst Says

- François revealed on X that Chainlink is not excluded from the launch, noting that large infrastructure tools usually experience a gradual adoption process.

- The New York Stock Exchange (NYSE) is developing a tokenized securities platform enabling 24/7 equities and ETF trading.

- Intercontinental Exchange (ICE) partners with banks for tokenized deposits; regulators must approve the shift.

The New York Stock Exchange’s (NYSE) move towards a tokenized, 24/7 trading platform has sparked chatter about which blockchain infrastructure providers will power on-chain markets. And according to crypto analyst Quinten François, Chainlink (LINK) had not been left out after the launch of the NYSE’s platform.

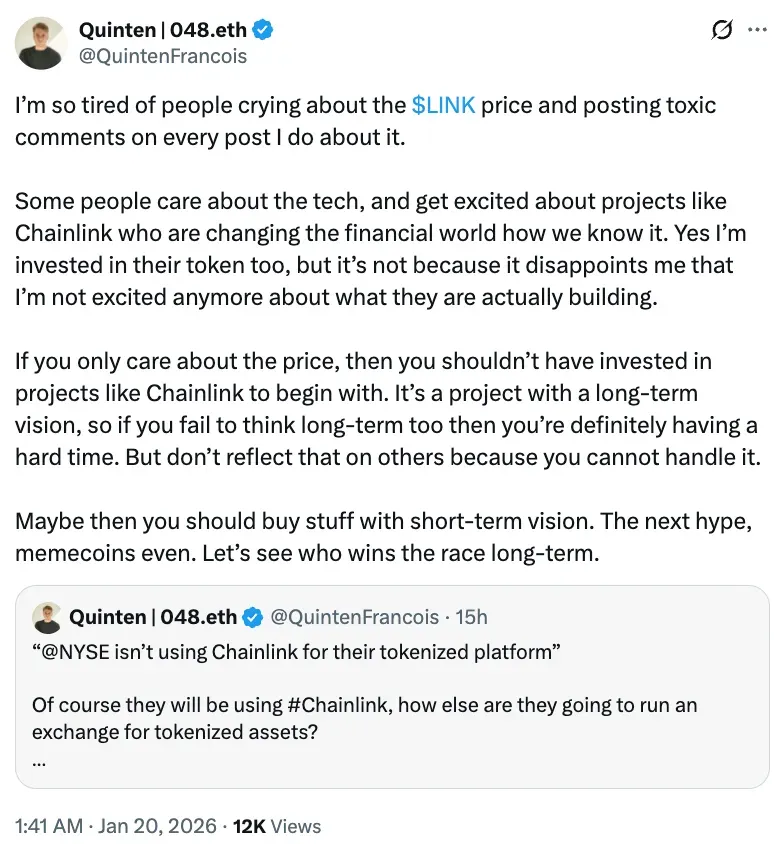

In a post on X, François stated that Chainlink is not excluded from the launch, noting that large infrastructure tools tend to be adopted slowly and scaled once adoption becomes visible.

Many investors, he added, are addicted to short-term price performance and overlook the fact that projects like Chainlink tend to play out over years, not days. He cautioned investors to differentiate between technological progress and speculative expectations.

"Some people care about the tech, and get excited about projects like Chainlink who are changing the financial world how we know it. Yes I’m invested in their token too, but it’s not because it disappoints me that I’m not excited anymore about what they are actually building."

Chainlink (LINK) was trading at $12.52, down 1.7% in the last 24 hours. On Stocktwits, retail sentiment around Chainlink dropped from ‘bullish’ to ‘neutral’ territory, accompanied by ‘normal’ chatter levels over the past day.

NYSE Wants 24/7 Stock And ETF On-Chain Trading

The New York Stock Exchange (NYSE) announced on Monday that the platform would support 24/7 trading, fractional and dollar-sized orders, and near-instant settlements using tokenized capital. The system would combine the exchange’s Pillar matching engine and blockchain-based post-trade infrastructure capable of supporting multiple settlement and custody chains.

According to the exchange, tokenized shares would be convertible into traditionally issued securities and would carry the same economic and governance rights, including dividends and shareholder voting rights. Distribution would follow existing market structure rules, with access provided to qualified broker-dealers.

The initiative forms part of Intercontinental Exchange’s (ICE) wider push toward always-on market infrastructure. ICE said it is working with banks, including the Bank of New York Mellon Corporation (BK) and Citi, to support tokenized deposits across its clearinghouses, enabling funding, margin, and liquidity management outside traditional banking hours.

Why Tokenization Is Moving Into Market Infrastructure

In a post on X, Fintech Executive Simon Taylor said NYSE’s move highlights the emergence of “two parallel systems”: traditional market hours and settlement rails alongside a new on-chain, 24/7 infrastructure, rather than merely experimenting with tokenization.

The announcement follows the U.S. transition to T+1 settlement in 2024 and comes amid similar tokenization efforts by market infrastructure providers and asset managers. This signals the growing institutional interest in blockchain-based trading and settlement without abandoning regulatory guardrails.

Read also: Is Bitcoin Repeating 2022 Playbook? One Whale Says The Comparison Is ‘Absolutely Unprofessional’

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_539991424_jpg_eeab1e0e26.webp)