Advertisement|Remove ads.

‘Worst Crypto Winter Ever?’ – Analysts Blame Everything From The Epstein Files To Capital Outflows For Bitcoin’s Drop To $65K

- Joe Weisenthal said the current downturn is the “worst crypto winter ever,” citing multiple pressures, including weaker retail activity, fading institutional support, and structural challenges across the industry.

- Other analysts offered mixed views, with some pointing to leverage and funding stress as key drivers of the sell-off, while others remained optimistic about crypto’s long-term outlook.

- Market data showed continued weakness, with Bitcoin down nearly 48% from its October peak, investor sentiment in “fear” territory, and liquidation activity remaining elevated.

Joe Wiesenthal of Bloomberg reported that the current downturn in digital assets represents the “worst crypto winter” on record.

Weisenthal shared on X a link to his Bloomberg newsletter, saying the market is facing “multiple forces all hitting at once,” ranging from credit risks to weakening retail and institutional participation. He coined the term “the worst crypto winter ever,” outlining ten factors behind the prolonged slump.

Weisenthal added that it is not the deepest decline but the most difficult because “multiple forces” are hitting the market at once. He pointed out that the “we’re so early” narrative has faded as crypto products have gone mainstream, while online hype has weakened and institutions have focused more on stablecoins than existing tokens.

Bitcoin In Epstein Files?

According to the journalist and TV show host, crypto has been a part of the recently released Epstein files as well, with “Bitcoin” showing up 1,512 times in the report. According to a New York Times report, some emails mention Jeffery Epstein’s ties with early Bitcoin developers, while stating that he invested nearly $3 million in Coinbase (COIN) back in 2014, after being introduced by crypto entrepreneur Brock Pierce.

In the meantime, a major structural tailwind facing Bitcoin (BTC) during the bull run, concerted buying from corporate treasuries, is starting to wane as these companies’ positioning shifts away from net buyer into large holders that could eventually become sources of supply in a bear market. Taken together, these dynamics have put pressure on the crypto market, said Weisenthal.

Bitcoin’s price was trading at $64,732.55, down over 8% in the last 24 hours. On Stocktwits, retail sentiment around BTC remained in ‘extremely bearish’ territory, as chatter continued to be at ‘extremely high’ levels over the past day.

Other Analysts Offer Mixed Views on Market Downturn

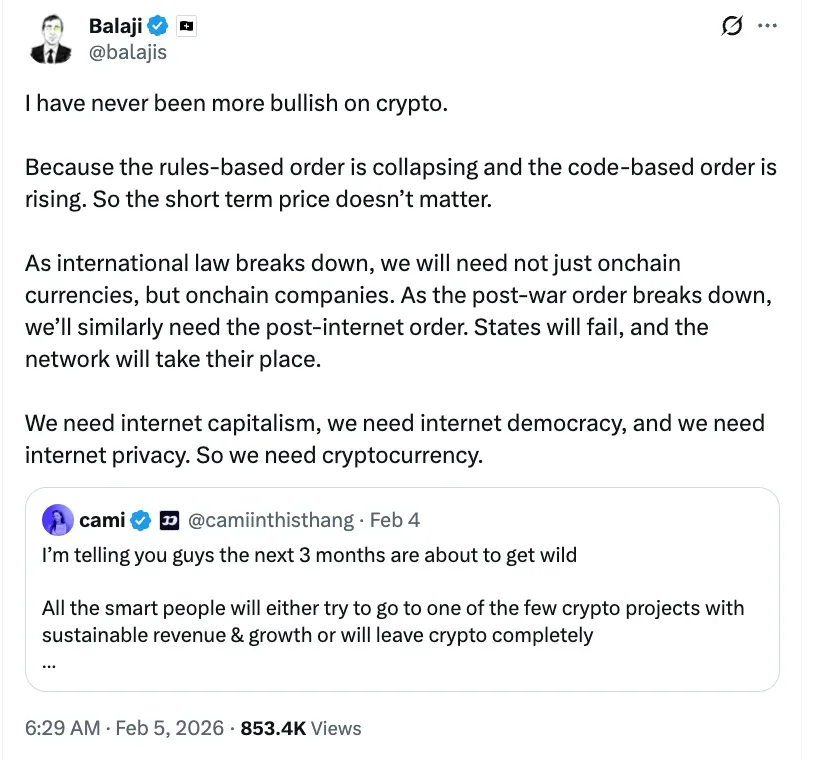

Other market commentators have offered differing views on the sell-off. The Short Bear shared on X that the decline reflected leverage and funding stress, while another market watcher, Balaji Srinivasan, added that he remained “more bullish on crypto”, arguing that short-term price moves mattered less.

Weisenthal’s analysis comes as Bitcoin remains well below its October peak and trading activity across major tokens has slowed. Bitcoin is nearly down by 48% from its October high, with Bloomberg Intelligence analyst Mike McGlone also pointing out broader market pressures, comparing crypto’s performance with gold, stocks, and bonds.

Market data showed continued stress. CoinMarketCap’s Fear and Greed Index remained in ‘extreme fear’ territory, while data from Coinglass indicated high liquidation activity in recent sessions.

Analysts and market participants have continued to discuss whether the recent decline reflects a short-term pullback or a longer-term shift in market conditions.

In a similar vein, Brett Knoblauch, Head of Digital Assets Research at Cantor Fitzgerald, said in January that it would be hard to know whether the market is in a long-term ‘bear’ sentiment. He also added that, “If people think we are in a crypto winter, it becomes a self-fulfilling prophecy,” referring to a situation in which buyers step back, selling pressure increases, and prices continue to fall.

Read also: Bessent Slams Crypto Lobby ‘Nihilists,’ Urges Regulation Holdouts To Leave U.S. Market

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ionq_resized_jpg_35563ea1fb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)