Advertisement|Remove ads.

Sangamo Therapeutics, Cyclacel Pharma, GE Aerospace: 3 Stocks Retailers Are Most Bullish Tuesday Afternoon

Sangamo Therapeutics, Inc. ($SGMO)

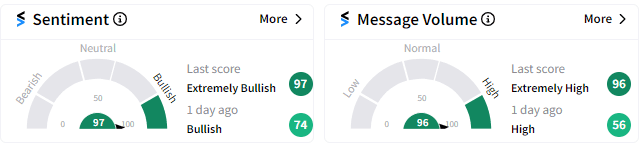

Sangamo shares spiked over 30% by the mid-session with sentiment on Stocktwits continuing to remain ‘extremely bullish’ for a second day in running. This marks a turnaround from a week ago when the sentiment score was 35/100.

As of 3:05 pm ET, pn Stocktwits the sentiment score was at 97/100. Message volume has improved from ‘normal’ a month ago to ‘extremely high’ this week.

On Tuesday, Sangamo announced its successful interaction with the U.S. FDA that provided a clear regulatory pathway to the accelerated approval for ST-920, a wholly-owned gene therapy to treat Fabry disease.

The drug regulator agreed in the interaction that the data from the ongoing Phase 1/2 STARR study can serve as the primary basis for approval under the Accelerated Approval Program.

“I strongly believe in the potential for ST-920 to alleviate many manifestations of Fabry disease and am delighted to have a clear regulatory pathway that could bring this treatment to patients significantly sooner than originally anticipated,” said Sandy Macrae, CEO of Sangamo.

The company said it plans to submit the Biologic License Application in 2025.

Cyclacel Pharmaceuticals, Inc. ($CYCC)

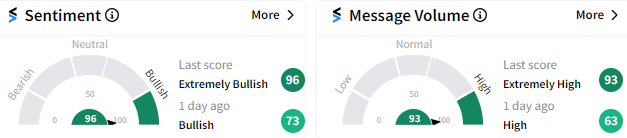

Nano-cap biotech Cyclacel also saw a surge in retail interest. The sentiment meter on Stocktwits was trending in the ‘extremely bullish’ territory, with a score of 96/100 as of 3:05 pm ET. This marked an improvement from the ‘bullish’ predisposition seen on Monday. Message volume has spiked significantly, with the corresponding score improving from 63/100 on Monday to 93/100.

The extremely positive stance of retail traders came ahead of the oncology-focused company’s presentation of the initial safety and efficacy data from 12 patients with advanced solid tumors enrolled in the Phase 2 part of the 065-101 clinical study of fadraciclib as a single agent.

The data is due to be presented between 6 am ET and1 pm ET on October 23, 2024 at the AACR-NCI-EORTC 36th Symposium on Molecular Targets and Cancer Therapeutics to be held in Barcelona, Spain.

GE Aerospace ($GE)

GE Aerospace stock was plunging on Tuesday following the company’s third-quarter results, which showed revenue coming in slightly shy of estimates. The adjusted earnings from continuing operations, however, beat the consensus.

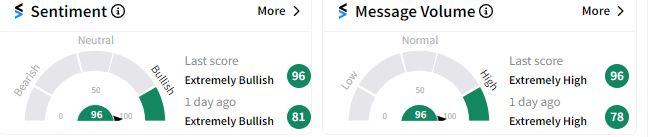

Retail investors threw their weight behind the company, with the sentiment score on Stocktwits at 96/100 as of 3:05 pm ET, suggesting ‘extreme bullishness.’ The score is up from 79 a day ago. Message volume has been extremely high, with a score of 96/100, up from 72/100 on Monday.

As of 3:05 pm ET, Sangamo was up 35.3% at $1.24, Cyclacel gained 12.55% to $1.49, while GE Aerospace fell 8.84% to $177.05.

Read Next: Texas Instruments Stock Slips Ahead Of Earnings, Retail Sentiment Turns Bullish Amid Rise In Chatter

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2154709092_jpg_25619abae6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Sourasis_Bose_Author_Image_939f0c5061.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2225993158_jpg_19f3808617.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_mumbai_city_jpg_607ef7484f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bumble_HQ_original_jpg_2b5a2acef3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/shanthi_v2_compressed_98c13b83cf.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_543225021_jpg_d5737b0d33.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wework_jpg_a1ffb0ea24.webp)