Advertisement|Remove ads.

Why Is Freeport-McMoRan Stock Gaining Premarket?

Freeport-McMoRan (FCX) stock rose nearly 2% in premarket trading on Friday after the copper miner received an upgrade by UBS.

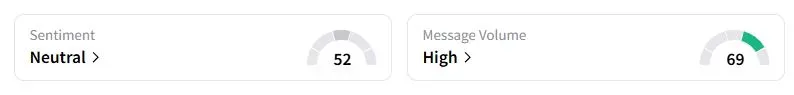

According to investing.com, UBS upgraded Freeport stock to ‘Buy’ from ‘Neutral’ and raised the price target to $48 from $42.5. The new price target implies a 23.5% upside compared to the stock’s previous closing price on Thursday. Retail sentiment on Stocktwits about Freeport McMoRan stock was in the ‘neutral’ territory at the time of writing.

The copper miner’s stock has been battered after it declared force majeure at the Grasberg project in Indonesia, the world's second-largest copper mine, following a mud flow incident that claimed the lives of at least two workers.

The company also said last month that for the third quarter of 2025, its consolidated sales are expected to be approximately 4% lower for copper and approximately 6% lower for gold than it estimated in July.

UBS analysts reportedly attributed the stock’s decline to investor worries that Grasberg’s recovery to pre-incident production levels might take longer than the company’s own projections, along with fears of potential long-term impairment to the mine’s value and production capacity.

UBS, after consulting with experts, reportedly believes that the risk of structural impairment to Grasberg’s production and value is low. The brokerage also noted that water challenges are relatively easier to solve at Grasberg, which is located up a mountain, compared to many other underground mines.

The brokerage also stated that investors are pricing in an "overly pessimistic outcome" for the Grasberg recovery, with current valuations implying that they expect 2027/medium-term Grasberg production to be more than 30% below previous guidance and normalized production levels.

Freeport stock has gained 1.8% this year, despite a surge in copper prices, primarily due to the impact of the Grasberg incident.

Earlier this week, Reuters reported, citing a minister, that Indonesia expects to sign a deal with Freeport soon, granting a local partner a 12% stake in its Indonesian unit, PT Freeport Indonesia.

Also See: This Energy ETF Is Heading Toward Its Worst Week In Four Months — Can A Late Rebound Save The Day?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244842667_jpg_931c352b95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1485519874_1_jpg_82b28a6517.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rare_earth_july_d867df7d47.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)