Advertisement|Remove ads.

Top 4 Communication Services Stocks That Caught Retail Investors’ Attention Last Week

The equity market pulled back sharply in the week ended March 14 as President Donald Trump’s tariff proposals and the threat of counter tariffs weighed down on stocks. Even amid the risk-off mood, some communication services stocks gained a strong following on Stocktwits last week.

These stocks include:

John Wiley & Sons, Inc. (WLY) - 90% week-over-week (WoW) increase in retail following

Hoboken, New Jersey-based John Wiley & Sons is a publishing company that offers scientific, technical, medical, and scholarly journals, as well as related content and services.

The retail interest in the stock came despite John Wiley & Sons stock declining 4.44% for the week.

The increased attention from retail traders may have come after the company announced the signing of an agreement with Pi School for providing access to a curated collection of Earth science research materials to help enhance the training and capabilities of the European Space Agency's Earth Virtual Expert.

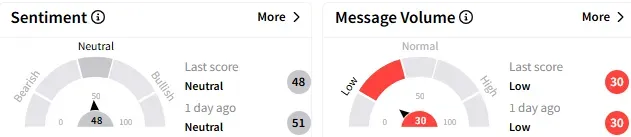

On Stocktwits, retail sentiment toward John Wiley & Sons stock stayed ‘neutral’ (48/100), with message volume remaining ‘low.’

E.W. Scripps Company (SSP) - 53% WoW increase in retail following

E.W. Scripps stock gained 76% in the past week after the Cincinnati, Ohio-based media company that owns a portfolio of local television stations, national news and entertainment networks reported its financial results for the fourth quarter of the fiscal year 2024.

Revenue growth climbed 34% year over year (YoY) to $511 million, driven by record political advertisement revenue, but the bottom-line result trailed the consensus estimate.

The stock also benefited from a multiyear agreement the company signed with Vegas Aces that will allow the former to televise all non-nationally exclusive Aces games – with distribution on cable, satellite and over-the-air television.

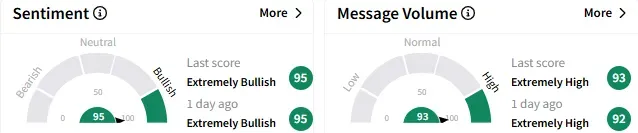

On Stocktwits, retail sentiment toward E.W. Scripps stock remained ‘extremely bullish’ (95/100), and the message volume was ‘extremely high.’

Giftify, Inc. (GIFT) - 18% WoW increase in retail following

Giftify stock fell over 12% over the past week despite the Schaumberg, Illinois-based company that operates a restaurant deals space announcing a significant increase in gift card sales following its announcement of a smart savings program for GLP-1 diabetes and weight loss medications.

A bullish user said Giftify would be the next stock on fire.

Able View Global Inc. (ABLV) - 13% WoW increase in retail following

Able View Global is a Shanghai-based advertising agency that operates as brand management partners of beauty and personal care brands. The stock shed more than 41% last week.

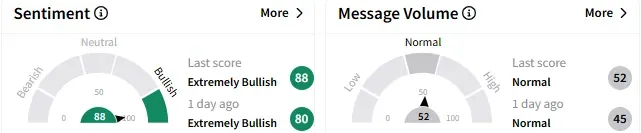

On Stocktwits, sentiment toward Able View Global stock stayed ‘extremely bullish’ (88/100), but the message volume remained ‘low.’

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Black_Rock_Bitcoin_ETF_IBIT_f66b744bfc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kraken_2091850a33.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215666275_jpg_07d03239b9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_2_jpg_a7bbca2bde.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)