Advertisement|Remove ads.

Nvni, Electronic Arts, Verizon And More: 6 Stocks That Saw Brisk Retail Activity On Stocktwits Last Week

Wall Street ended the holiday-shortened week higher, with the S&P 500 Index rising in three of the four sessions of the week. The broader gauge ended off its highs due to a modest pullback on Friday as traders positioned themselves for the unfolding week’s tech earrings and the Federal Reserve’s interest-rate decision.

Against the backdrop, here’s a compilation of a few tech, communication services and entertainment stocks that triggered frenzied activity among retailers on the Stocktwits platform over the last week:

Nvni Group Limited (NVNI)

Shares of Sao Paulo, Brazil-based B2B software-as-a-service (SaaS) platform provider Nvni Group jumped 180% last week after the company announced it regained compliance with the Nasdaq exchange’s minimum closing bid price requirement.

The seven-day message volume on Nvni stream on the platform spiked by 17,640%.

Sentiment toward Nvni stock has tempered since then, with the meter on the Stocktwits platform showing a ‘neutral’ mood (49/100) among retailers. Message volume also tempered to ‘normal’ levels.

Electronic Arts, Inc. (EA)

Video game software maker Electronic Arts came under selling pressure last week after the company downwardly revised its fiscal year 2025 third-quarter bookings growth and revenue guidance. The company blamed the predicted shortfall on the weakness experienced by its global football franchise

Electronic Arts stock plunged nearly 17% on Friday and ended the week down 18% at $116.56.

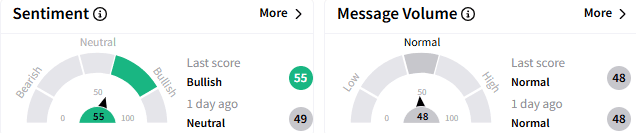

On Stocktwits, sentiment toward Electronic Arts stock improved to ‘bullish’ (55/100) from ‘neutral’ a day ago, with message volume stuck at ‘neutral’ levels.

Message volume over the past seven days has risen an impressive 15,100%.

Asset Entities, Inc. (ASST)

Dallas, Texas-based Asset Entities provides social media marketing and content delivery services on Discord, TikTok, and other platforms. Its stock jumped 141% over the past week.

The buoyancy in the stock can be traced back to the amendments the company made to its preferred stock provisions, setting a new floor price, and receiving shareholder approval for the same.

Messages on the Asset Entities stock stream on Stockwits showed retailers' optimism regarding President Donald Trump facilitating a deal for Oracle to buy TikTok.

Message volume on the Asset Entities stream spurted by 3,214% over the past seven days.

Match Group, Inc. (MTCH)

Shares of dating services provider Match Group, which owns brands such as Match.com, Tinder, Meetic, OkCupid, and others, rose over 4% over the past week. Stung by fundamental softness, the stock shed over 10% in 2024.

The company’s third-quarter results released in November showed subpar Tinder Direct revenue, with the weakness blamed on the underdelivery of some optimizations. It noted that certain initiatives rolled out in the third quarter cannibalized subscription revenue by more than expected. This weakness will linger in the fourth-quarter.

A class action lawsuit has been filed against the company, alleging the company made materially false and/or misleading statements.

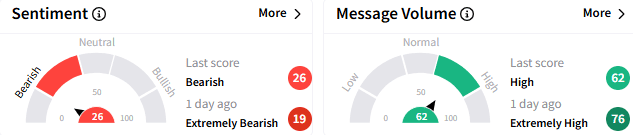

On Stocktwits, sentiment toward Match Group stock turned ‘extremely bearish’ (26/100) from ‘bearish’ a day ago but message volume reduced to ‘high’ levels.

The seven-day message volume was up 2,250%.

Starbox Group Holdings Ltd. (STBX)

Micro-cap Starbox Group stock plunged nearly 43% in the week ended Jan. 24. The Malaysia-based company provides cash rebates and digital advertising services to retail merchant advertisers through websites and mobile apps in Malaysia.

The company announced in a filing with the SEC that it entered into a software purchase agreement with Aurelius Group for a cutting-edge 3D rendering system module and related assets. The purchase price, made in stock, has an aggregate value of $16 million.

Over the past seven days, the increase in message volume was 1,543%

Verizon Communications, Inc. (VZ)

Shares of Verizon rose nearly a percent on Friday, outperforming the broader market, after the telecom giant’s fourth-quarter adjusted earnings per share (EPS) came in at $1.10, in line with the consensus, and operating revenue climbed 1.6% year-over-year (YoY) to $35.68 billion, slightly ahead of the $35.36 billion Street estimate. Its wireless service revenue rose 3.1%.

The quarter saw 568,000 post-paid subscriber additions, the highest growth in five years for this key operational metric.

On Stocktwits, sentiment toward Verizon stock has worsened to ‘bearish’ (42/100) from ‘neutral’ a day ago. Message volume has trickled down to ‘low’ levels.

The Verizon stream on the platform was a 1,270% uptick in weekly message volume over seven days.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)