Advertisement|Remove ads.

A JPMorgan Upgrade Of This Bitcoin-Linked Stock Has Ignited Retail Buzz On Stocktwits: More Details Inside

MARA Holdings, Inc. (MARA) received a notable vote of confidence from JPMorgan analyst Reginald Smith, who raised his rating on the stock to ‘Overweight’ from ‘Neutral’ ahead of the company’s second-quarter (Q2) earnings on Tuesday.

The upgrade comes with a new price target of $22, an increase from the earlier estimate of $19, according to TheFly.

Following the upgrade, MARA stock traded nearly 3% higher in Monday’s premarket.

The stock saw a 102% increase in user message count in the last 24 hours. Stocktwits users said they are excited about the upcoming earnings.

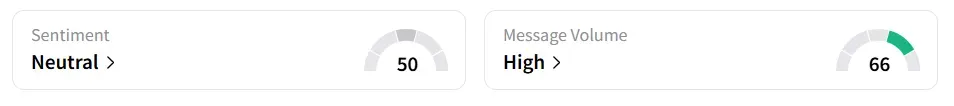

Retail sentiment around the stock remained in ‘neutral’ territory amid ‘high’ message volume levels.

Smith said investors may be underestimating the company’s upward revision in its mining hash-rate forecast for fiscal year 2025. The company is targeting 75 exahash by the end of 2025.

This suggests the market hasn't fully appreciated the scope of Mara’s infrastructure expansion plans, including capital expenditure obligations.

Mara is positioning itself to capture more market share in the evolving cryptocurrency mining space.

On July 23, MARA said it will raise $950 million through a private offering. Funds from this offering are likely to support the company’s strategic initiatives in scaling digital asset operations and expanding infrastructure capabilities.

MARA mined a total of 713 Bitcoins (BTC) in June, down from 950 in May, reflecting a 25% drop. As of June 30, MARA held 49,940 BTC.

For the first quarter of 2025 (Q1), the company’s revenue climbed 29.4% YoY to $213.8 million, missing the analyst consensus estimate of $217.5 million, as per Fiscal AI data.

MARA stock has gained over 2% year-to-date and has shed over 15% in the last 12 months.

Also See: AI Boom Or Bust? Alibaba Cloud’s Founder Says Most Of Today’s Apps Won’t Survive The Decade

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257248307_jpg_6720435e43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jim_cramer_OG_2_jpg_b3d8e3bbe7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)