Advertisement|Remove ads.

A Low-Hype Software Stock More Than Doubled This Year: What’s Driving It — And Is There Upside Left?

- Growth has reaccelerated, with expanding partnerships with AWS and Nvidia reinforcing JFrog’s role in DevSecOps and AI-driven software delivery.

- While the stock trades at a premium valuation, analysts remain bullish, citing sustained growth, improving security traction, and continued upside.

- Retail sentiment, however, has mainly remained downbeat.

The year belonged to high-profile artificial intelligence stocks, primarily the hyperscalers, the AI-hardware manufacturers, and data center infrastructure companies. But one lesser-known name belonging to the less glamorous software space beat most of these showstealers fair and square. And what’s more, its stock is believed to have upside potential from the overbought levels.

Meet the Sunnyvale, California-based outperformer — JFrog, a mid-cap software-as-a-service company that provides a global software supply chain platform. The company empowers development teams by enabling a fast, seamless, and secure flow of software from developers’ keyboards to devices, which it calls “Liquid Software.” Outlining its goal, the company says:

“We are driven and inspired to automate DevOps, SecOps and IoT organizations, enabling a world where software updates are continuous, fast and fearless.”

FROG Stock Leapt In 2025

JFrog made its public debut amid the thick of the COVID-19 pandemic, and after the typical pre-initial public offering (IPO) surge, the stock began to lose its footing and fell steeply. It hit bottom in the middle of 2022 and has been recovering since then.

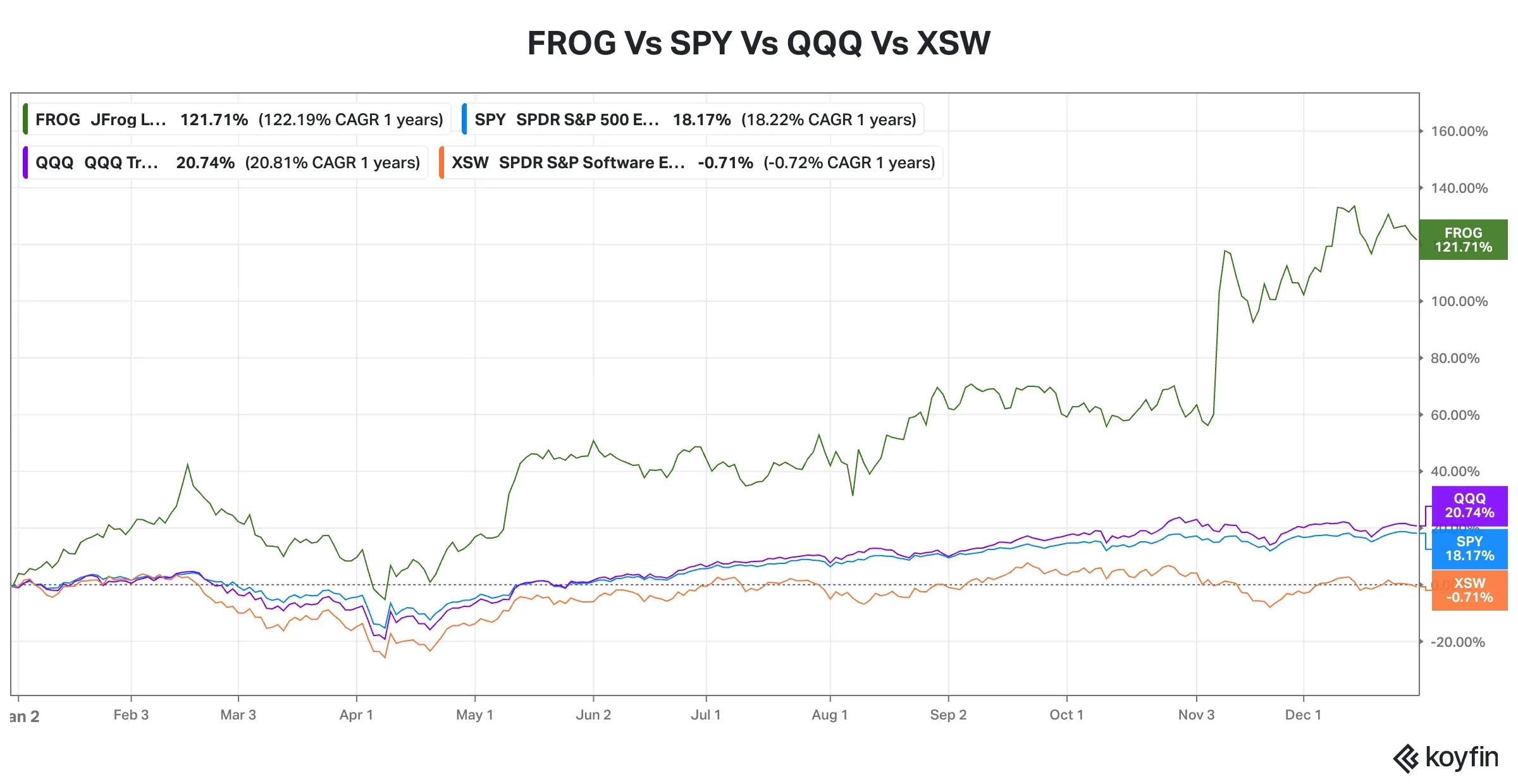

For the year-to-date (YTD) period, JFrog’s stock has returned nearly 122%, with one more session to go. It has outperformed the broader market, the technology sector and the software industry this year.

Source: Koyfin

Source: Koyfin

The YTD chart shows a strongly bullish trend across short, medium, and long timeframes, given the stock trades above its 50-day, 100-day, and 200-day simple moving averages. The 14-day relative strength index (RSI) suggests the stock is in the ‘neutral’ zone.

Source: Koyfin

Source: Koyfin

What’s Powering The JFrog Rally?

JFrog claims to have more than 80% of Fortune 500 companies as its customers, and it has stitched up several partnerships throughout the year. At the start of the year, the company signed an expanded collaboration agreement with Amazon’s AWS to allow enterprise customers to migrate workloads to AWS swiftly.

The company also announced two agreements with Nvidia: general availability of its integration with Nvidia NIM microservices, part of the latter’s AI Enterprise software platform, and integration of its foundational DevSecOps tools with the Nvidia Enterprise AI Factory validated design.

Revenue for the last reported quarter rose 26% year over year (YoY) to $136.9 million, and the non-GAAP gross margin was a commendable 83.9%. At the end of the quarter, the remaining performance obligations, which combine deferred revenue and revenue backlog, stood at a solid $508 million. After a slowdown in year-over-year growth, the company has seen a reacceleration since the first quarter of this year.

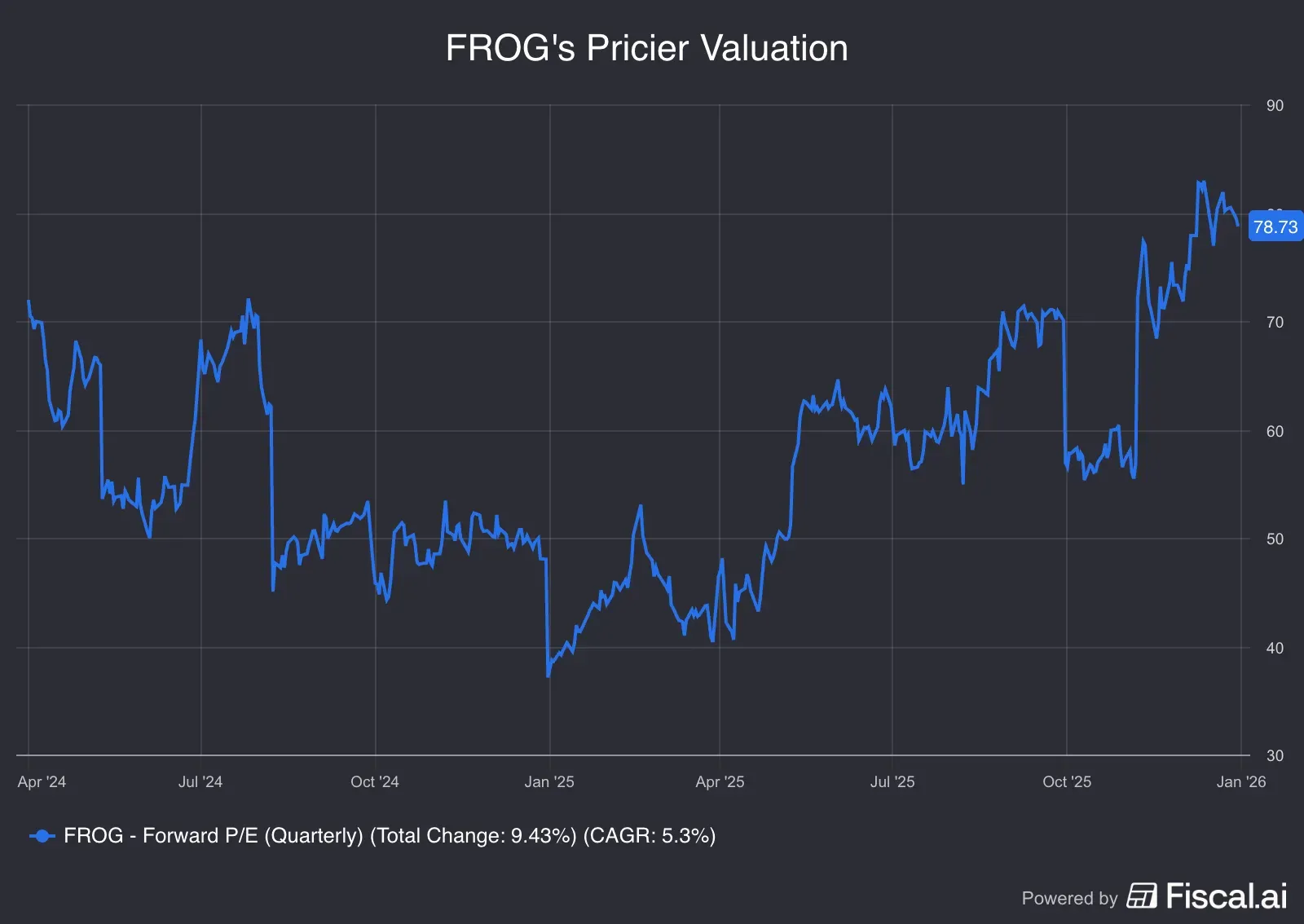

Source: Fiscal.ai

The valuation, however, stirs uneasiness. The forward price-earnings (P/E) multiple for the stock is 78.73, a premium multiple relative to the S&P 500’s 22.5 and the IT sector’s 27.1.

Source: Fiscal.ai

Retail’s Verdict

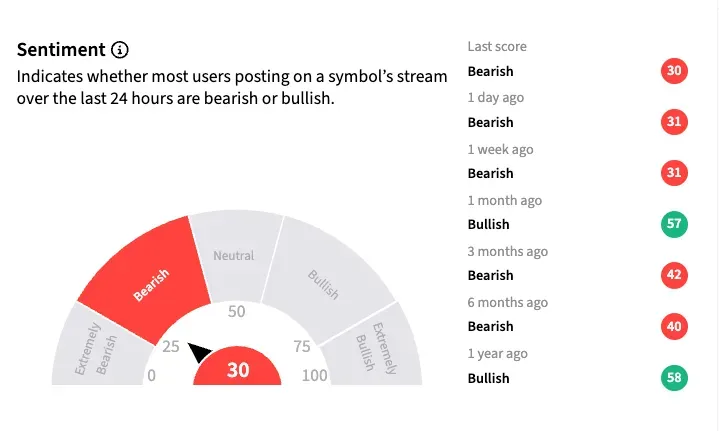

Retail users of the Stocktwits platform have harbored ‘bearish’ sentiment toward JFrog’s stock for much of the year.

Analysts are optimistic. Out of the 20 analysts covering the stock, 18 have either a ‘Buy’ or ‘Strong Buy’ rating, and two remain on the sidelines. The average analyst price target for the stock is $71.32, implying nearly 10% upside from current levels.

Earlier this month, BTIG analyst Nick Altmann initiated coverage of JFrog stock with a ‘Buy’ rating and a $83 price target, the Fly reported. The analyst sees the stock rally as a function of growth reacceleration and expects the growth to continue in the medium term, thanks to the strengthening of the company’s Artifactory, a universal artifact repository manager, and heightened traction in core security. UBS said in a note in late November that its channel checks revealed no slowdown in demand or competitive pressure.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Is Molina Healthcare The Next GEICO? Michael Burry Feels It's A ‘Special One’

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2185805420_fotor_2025011795638_6fbb0bb63f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_jpg_64b4ea4fc0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_war_jpg_f2a208ae56.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_M_and_A_deals_acquisitions_resized_jpg_a56d5b5e28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)