Advertisement|Remove ads.

Is Molina Healthcare The Next GEICO? Michael Burry Feels It's A ‘Special One’

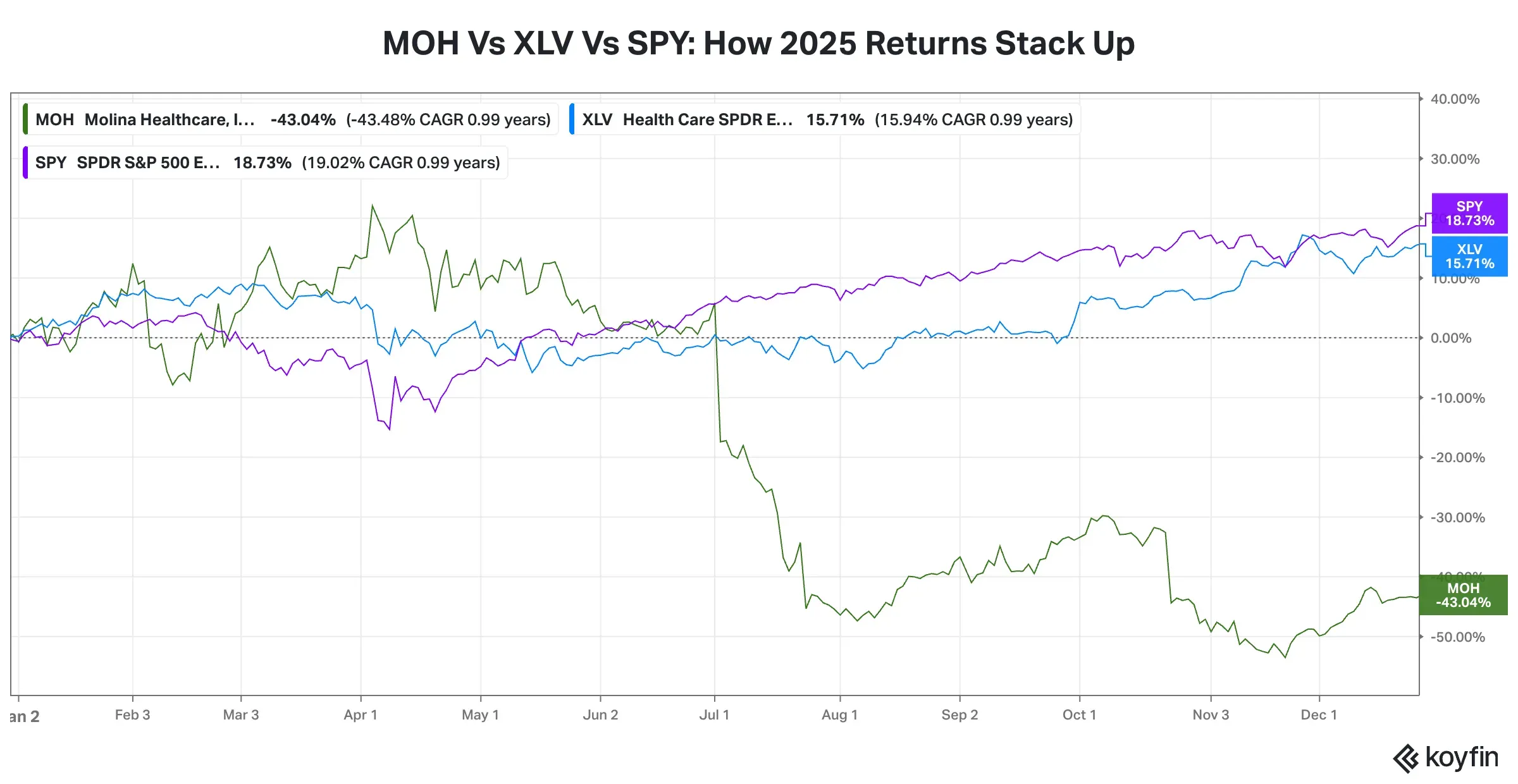

- Molina has struggled with slowing revenue growth, stagnant membership, thin margins, and elevated medical costs—particularly in its ACA marketplace business—while facing intense competition from larger managed care rivals.

- Uncertainty around Medicaid and Medicare policy, including potential changes under a Trump administration, continues to weigh on the outlook.

- Most analysts maintain neutral ratings and see limited upside despite improving retail sentiment.

Molina Healthcare, Inc. (MOH) did not merely have a forgettable year but a torrid one, as it underperformed the broader market and the healthcare sector significantly. However, hedge fund manager Michael Burry — best known for his prescient short positions — recently offered encouraging comments about the health insurer. His assessment should provide a glimmer of hope for investors who chose to stick with Molina’s stock despite its disappointing run this year.

Source: Koyfin

Source: Koyfin

What Burry Likes About Molina

Scion Asset Management, run by Burry, disclosed in an early November 13F filing for the third quarter a fresh position in Molina, buying 125,000 shares valued at $23.92 million. The hedge fund has since deregistered itself.

Later in a post on X in mid-November, the fund manager said he was long on Molina. The stock climbed 3.2% in the very next session following his comments. A month later, he posted again, sharing a news story about four Republicans forcing a vote on an extension of Obamacare subsidies. “This may support MOH, but in the long run matters little to the thesis. I, of course, still like the stock,” he said.

Now, Burry has shared a full Substack post entitled “Molina Healthcare: Ghosts of GEICO Past.” He has likened Molina to the early-stage GEICO investment made by the iconic investor Warren Buffett.

“Most investors simply do not understand insurance companies well enough to invest in them. I have spent a few decades looking at them, and I think I have a handle on it.”

He suggested Molina is a “special one” in the insurance industry, “like Warren Buffett found in his wildly successful GEICO investment.”

Buffett’s GEICO bet is a well-worn investing tale. After buying the auto insurer’s stock as a college student in 1951, his tryst with the insurer continued. Through Berkshire Hathaway, an investment holding company he has been running as CEO for about six decades, he began amassing shares in GEICO in 1976 and then bought it outright in 1996. Buffett is set to step down as CEO on Wednesday. Berkshire’s latest quarterly results show that GEICO generated revenue of $11.26 billion and raked in earnings before income taxes of $1.77 billion. It is among Berkshire's most profitable subsidiaries.

Burry has a Buffett connection despite their differing investment ideologies. He says his social-media handle “Cassandra” was given to him by Buffett, referring to the Trojan prophetess whose accurate warnings went unheeded—an apt parallel to his precise prediction of the housing market collapse.

In his latest post, Burry argued that GEICO stock, though a “real steal” for Buffett in 1976, was riskier than buying Molina today, Business Insider reported. The “Big Short” fame investor said Molina has a better business proposition in many ways. He sees Molina having a clearer path to significant double-digit long-term earnings than Apple.

“Maybe Buffett, if he were in his 40s and only just ramping up his insurance investments, would buy it here for a much smaller Berkshire.”

Burry also said he would have bought the company if he had had enough billions.

Molina Worth High Praise?

Founded in 1980 by an emergency room physician named Dr. David Molina in Long Beach, California, the company began modestly with a network of primary care clinics. It then became a large managed care organization (MCO) under the government-sponsored Medicaid and Medicare programs, and through the state insurance marketplaces.

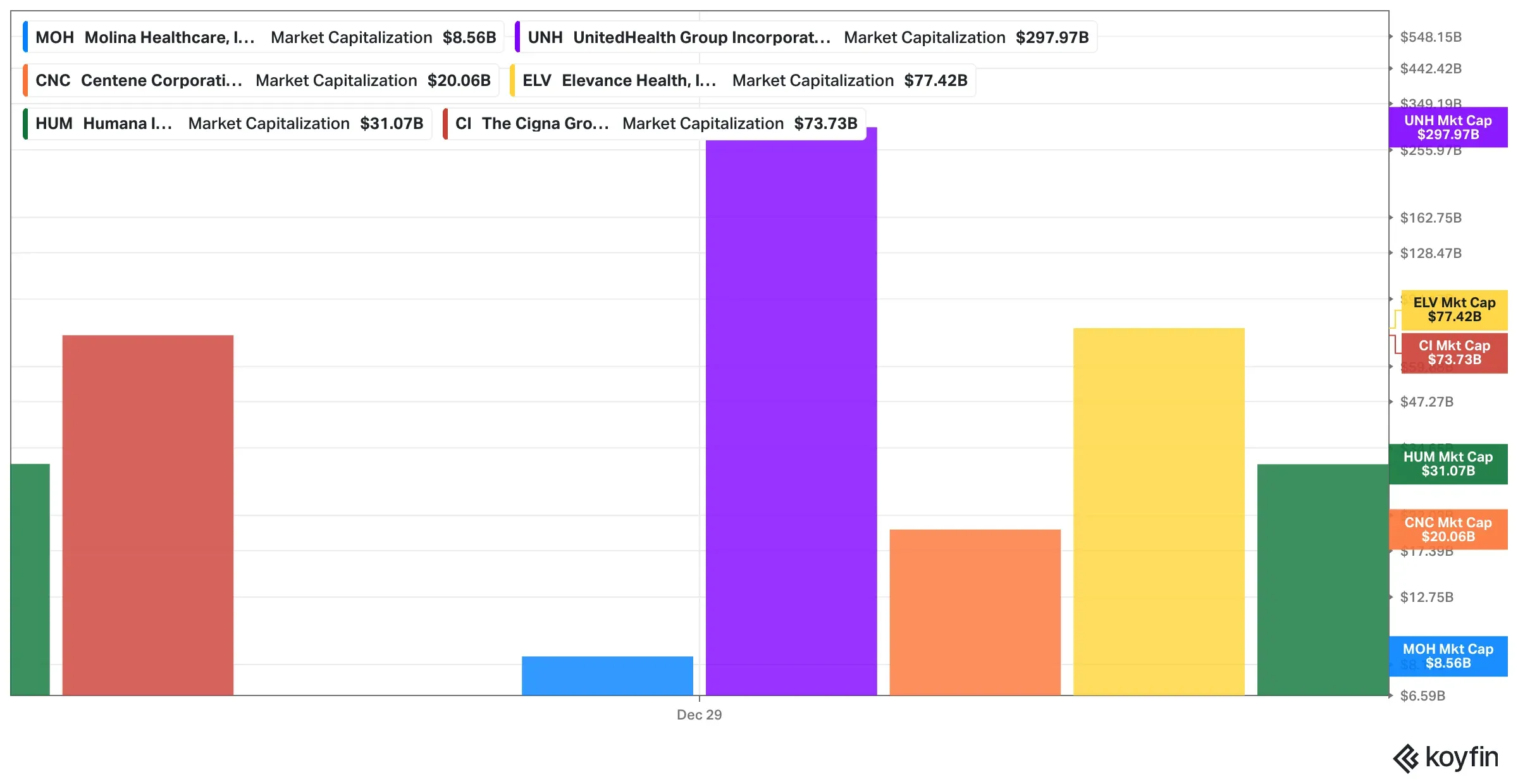

Molina operates on a national scale, but it is up against larger peers such as UnitedHealth, which had its fair share of woes this year, Humana, Cigna, Centene, and Elevance Health, born out of the merger between Anthem and WellPoint Health in 2004.

Molina Vs Peers (Valuation)

Source: Koyfin (data as of Dec. 29)

Source: Koyfin (data as of Dec. 29)

About 95% of Molina’s third-quarter revenue came from premiums. For the full year, it expects premium revenue of $42.5 billion. Commenting on the quarterly results, CEO Joseph Zubretsky said:

“The headline for the quarter is that approximately half of our underperformance is driven by the Marketplace business, and that Medicaid, while experiencing some pressure, is producing strong margins.”

Quarterly revenue has flatlined at around $11 billion, and growth has slowed. The company derives the bulk of its revenue from the Medicare segment (70% of the total Q3 revenue). Membership growth hasn’t changed markedly, remaining between 5 million and 6 million since 2021, and the margin profile isn’t attractive either.

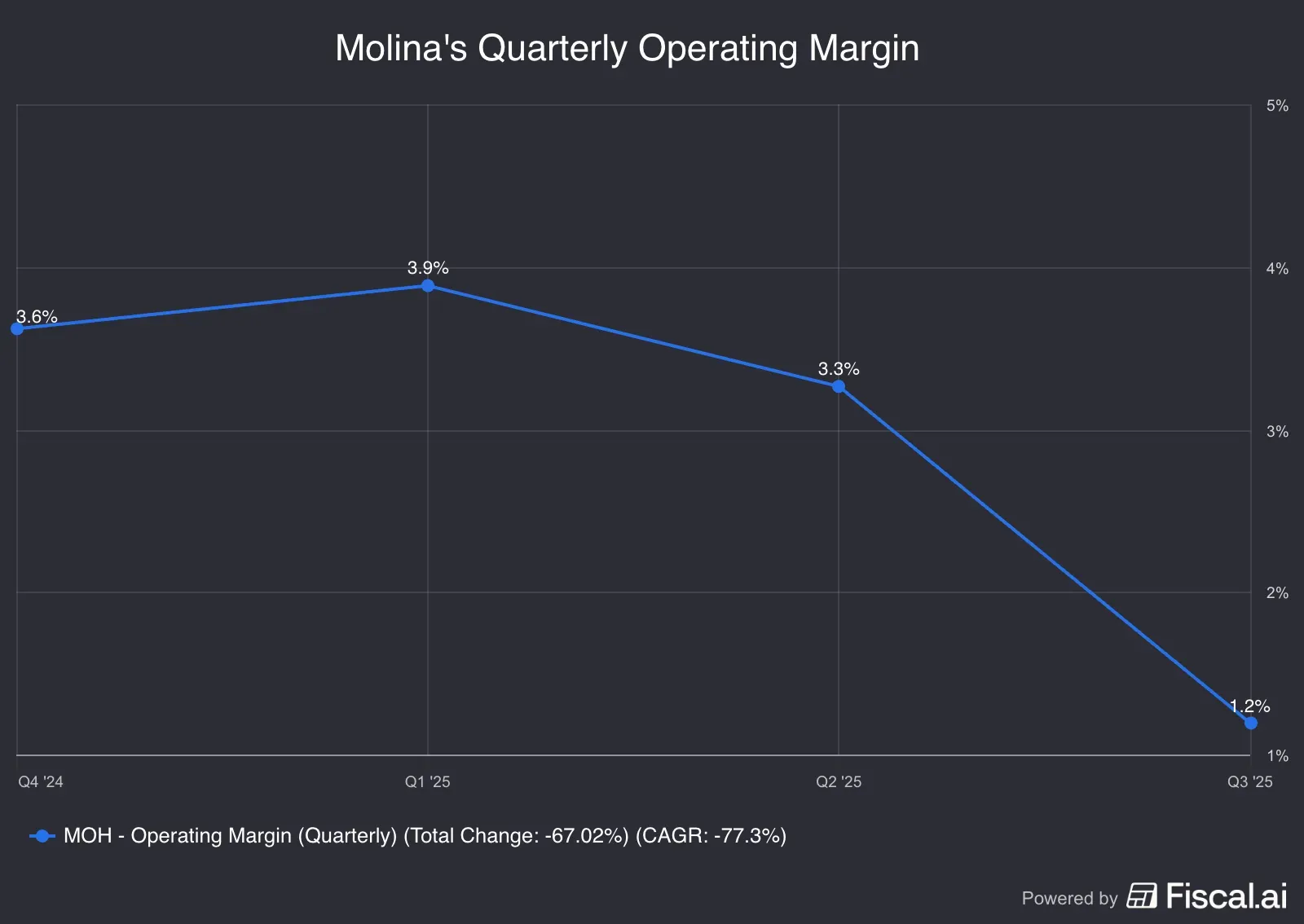

Source: Fiscal.ai

The third quarter saw a dip in operating margin to 1.2% as higher-than-expected medical cost trends, particularly in the Affordable Care Act marketplace, increased the medical care ratio — a key measure of profitability for an insurer.

Source: Fiscal.ai

Looming Risks

The Trump administration’s evolving healthcare policy poses a significant risk to Molina. The changes in Medicaid and Medicare policy, including eligibility standards, funding allocation and reimbursement frameworks, could weigh down on revenue and longer-term margins. After announcing agreements with drug firms to lower prescription drug prices, the president said he would also meet with insurers to reduce prices.

In a note released in early December, Cantor Fitzgerald said CMS Medicaid work requirement guidance, mandated via Trump’s tax bill, suggests a challenging year ahead for Medicaid, the Fly reported. The new CMS guidance dictates how states can plan to implement Medicaid work requirements and some elements of it, including that Payors cannot help determine if a Medicaid beneficiary is complying with work requirements, came as a surprise, the firm said.

Jefferies reduced the price target for Molina in a note released in mid-December. The firm maintained a ‘Neutral’ rating. The firm’s price target cut was to account for its expectations of an enhanced Medicaid Medical Loss Ratio (MLR) build and detailed Trump tax law assumptions, resulting in a slight downward adjustment to the valuation.

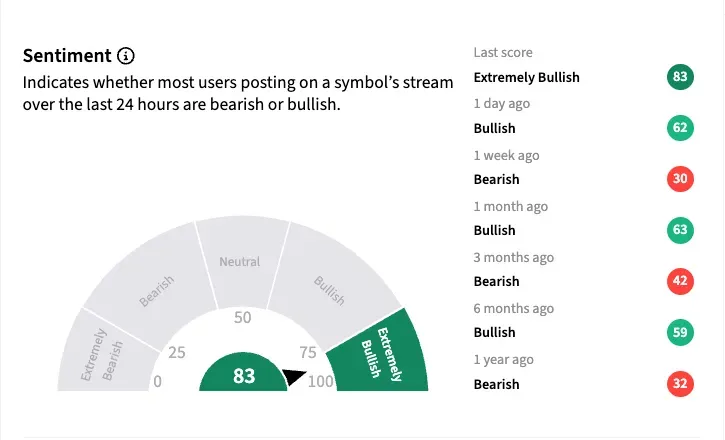

Retail sentiment toward Molina stock on Stocktwits has improved to ‘extremely bullish’ as of early Wednesday. Burry’s Molina comments set off brisk retail chatter, with the 24-hour message volume rising 850%.

Analysts hold a muted view of the stock, with 12 of the 18 analysts rating it ‘neutral,’ according to Koyin. Two analysts have a ‘Strong Sell’ rating, and four analysts have a ‘Buy’ rating. The average analyst rating for the stock is $176.63, implying merely 3.5% upside from current levels — a not attractive proposition, considering the year’s slump.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_bitcoin_OG_jpg_fbd13fff2e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nintendo_switch_2_jpg_bccd766d3b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245602336_jpg_dcf0764466.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_861ba86dd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_3_jpg_3ea694b5e1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240006388_jpg_320990af67.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)