Advertisement|Remove ads.

Apple Stock Under Pressure After Barclays Points To Signs Of Weak iPhone 16 Demand: Retail On The Fence

Shares of Apple, Inc. (AAPL) fell 1.2% pre-market on Tuesday, dragging retail sentiment down slightly, after finishing the previous session in the green.

Barclays triggered some concern, reporting that its channel checks showed a potential cut in iPhone 16 orders for the December quarter at a key Taiwanese supplier. The firm highlighted that global lead times for iPhone 16 models remain shorter than usual, pointing to weaker demand.

The brokerage also suggested that Apple might have slashed roughly 3 million units from its semiconductor components order, which could mark the "earliest" iPhone build cut in recent history.

According to Barclays, global iPhone 16 sales were down 15% year-over-year in the first week. The brokerage maintained its ‘Underweight’ rating with a $186 price target.

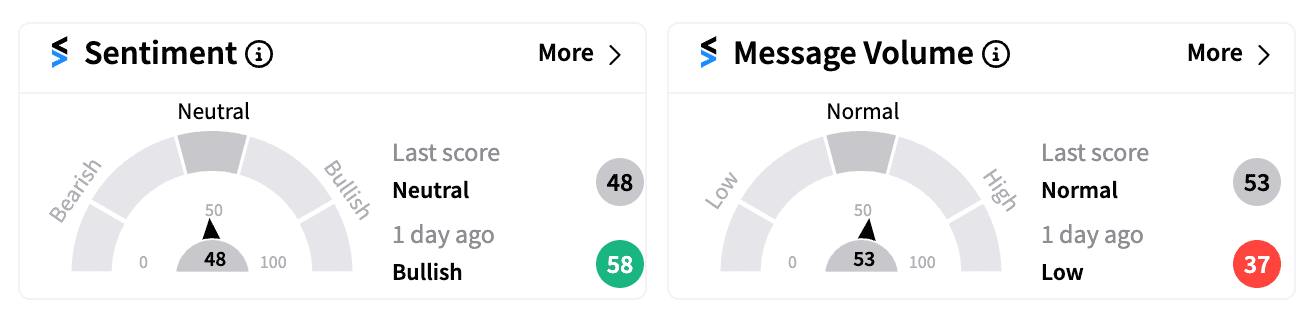

Retail sentiment on Stocktwits dropped from ‘bullish’ to ‘neutral’ early on Tuesday, after message volume surged by 1140% in the previous session.

Many retail investors expressed skepticism toward Barclays’ outlook, while others also cited the potential impact of the ongoing International Longshoremen’s Association strike at East Coast and Gulf Coast ports just ahead of the crucial holiday shopping season.

Some users remained optimistic, following notes from analysts, including Morgan Stanley and JPMorgan, that provided a more upbeat assessment.

A growing point of frustration has been Apple’s delay in rolling out its in-house AI features, branded as “Apple Intelligence,” which were expected to boost demand for the iPhone 16 lineup.

Adding to concerns, Reuters reported that a fire at Tata Group’s iPhone component plant in southern India could hamper production ahead of the festive shopping season, pushing Apple suppliers to source critical parts from China or elsewhere.

Despite Tuesday’s dip, Apple had a strong day on Monday, ending as the best performer in the Dow Jones Industrial Average (DJIA).

The stock is up 25% year-to-date, outperforming both the S&P 500 and the Nasdaq, and is less than 1% below its all-time high of $234.82 reached in July.

Read next: CVS Stock Rises, Grabs Retail Attention After Report Of Potential Breakup

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)