Advertisement|Remove ads.

Apple Stock Edges Up Pre-Market Ahead Of iPhone 16 Launch: Retail Isn’t Fully Sold On The Hype Yet

Apple Inc. (AAPL) shares rose slightly in pre-market trading Monday, as the tech giant gears up for the highly anticipated launch of its iPhone 16 lineup (iPhone 16, 16 Plus, 16 Pro, and 16 Pro Max) later in the day.

The new models are expected to feature in-house AI capabilities, but some analysts warn that this launch might not trigger a massive “super cycle” of orders.

According to Bloomberg’s Mark Gurman, Apple’s delayed roll-out of many promised AI features could temper initial demand. Some critical functions — such as ChatGPT-like capabilities — won’t be included in the first iteration of Apple Intelligence, and the service will not be available in key markets, including the EU and China.

Gurman also cites ongoing economic challenges, such as smartphone market softness in China and cautious consumer spending globally, as factors likely to weigh on sales.

While Apple’s AI ambitions face hurdles, analysts expect updates to the Apple Watch and AirPods to rejuvenate the company's struggling wearables segment.

Another big question heading into Monday’s event is pricing: Apple has largely resisted price hikes in recent years, and maintaining stable prices could boost adoption, particularly if AI features resonate with consumers.

Historically, Apple shares have seen modest movements on iPhone launch days. The stock soared 8.3% when the original iPhone debuted in 2007 but has since averaged a muted 0.3% return on launch days, according to Dow Jones Market Data. Last year, AAPL shares dipped 1.7% on announcement day.

Bank of America analyst Wamsi Mohan suggests that Apple’s stock typically pulls back after launch events but often recovers within 30 to 60 days.

However, a compelling demo of Apple Intelligence, third-party integrations, or unexpected price adjustments could see the stock perform better than in previous years, he has said.

BofA sees the iPhone 16 launch as the beginning of a multi-year software-driven upgrade cycle and maintains a ‘Buy’ rating with a $256 price target on Apple shares.

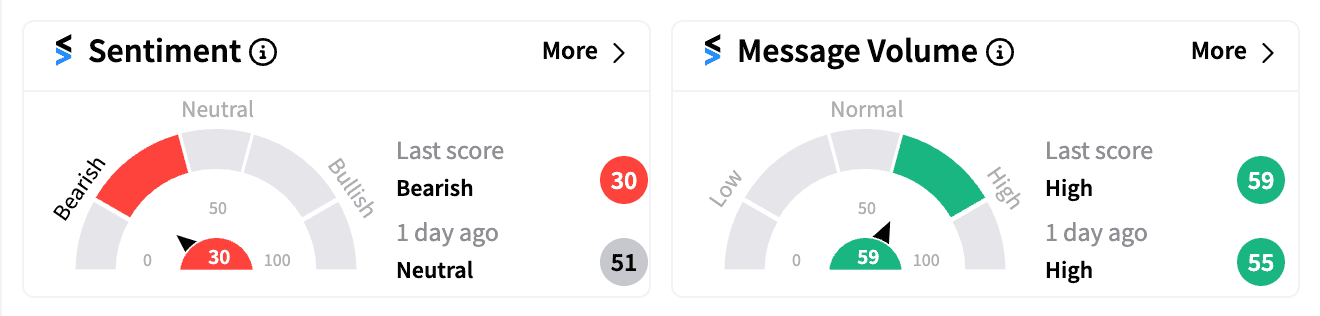

On Stocktwits, AAPL sentiment was bearish (30/100) on Monday, reflecting cautious retail investor attitudes despite the hype.

The iPhone 16 launch event, branded "It's Glowtime," starts at 1 p.m. ET and will be streamed live on Apple’s website.

With AAPL stock up nearly 19% this year, all eyes are on whether the latest iPhone can keep the momentum going.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)