Advertisement|Remove ads.

Abbott Stock Rises On Strong Q1 Earnings: Retail’s In Wait-And-Watch Mode

Shares of Abbott (ABT) traded 5% higher on Wednesday morning after the company’s first quarter (Q1) earnings exceeded estimates.

The company reported Q1 sales of $10.36 billion, marking an increase of 4% year-on-year on a reported basis, but below an analyst estimate of $10.42 billion, as per FinChat data.

The company’s 3.8% sales jump in its nutrition segment and 9.9% rise in its medical devices segment helped offset a steep 7.2% drop in sales from its diagnostics segment. The medical devices segment accounted for a whopping 47% of the company’s overall sales in the quarter.

The company reported adjusted diluted earnings per share (EPS) of $1.09, up from $0.98 in the corresponding period last year and marginally higher than an analyst estimate of $1.07.

Abbott reaffirmed its full-year 2025 financial guidance and sees full-year 2025 adjusted diluted EPS of $5.05 to $5.25. The company expects adjusted diluted EPS of $1.23 to $1.27 for the second quarter.

Abbott also expects full-year 2025 organic sales growth to be 7.5% to 8.5%.

The company’s two new manufacturing and research and development investments in Illinois and Texas, totaling $500 million, are projected to go live by the end of 2025.

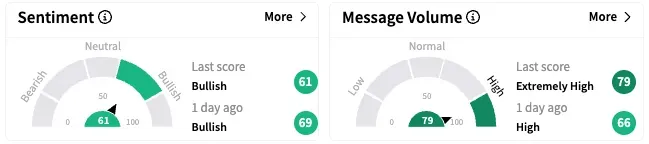

On Stocktwits, retail sentiment around Abbott fell eight points within the ‘bullish’ territory over the past 24 months while message volume rose from ‘high’ to ‘extremely high.’

ABT stock is up by about 17% year-to-date and over 21% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_digitalpayments_resized_png_5e564e753b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2208385583_jpg_9511ec9642.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229273911_jpg_6b4851e2cc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_autozone_resized_jpg_8733836467.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kashkari_original_jpg_b7db42a385.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_cigna_shares_resized_2250d1271f.jpg)