Advertisement|Remove ads.

Abercrombie & Fitch Stock Stumbles On Potential Impact From Trump Tariffs, But Retail’s More Optimistic

Abercrombie & Fitch Co. (ANF) shares slumped more than 9% on Wednesday after the apparel company's guidance fell short of Wall Street expectations as it warned about a potential hit from U.S. tariffs, but retail sentiment turned upbeat.

Earnings per share for Q4 surpassed estimates, coming in at $3.57, while revenue topped estimates, coming in at $2.58 billion. The company saw net sales growth of 9%, with comparable sales growth of 14%.

For Q1, it has projected net sales growth of 4% to 6%. For 2025, it expects net sales growth of 3% to 5%.

Net income per diluted share for 2025 is expected between $10.40 to $11.40 for 2025, compared to consensus estimate of $11.30.

"In fiscal 2024, we once again delivered on our commitments to our global customers and shareholders," said Fran Horowitz, Abercrombie's CEO. "Our expectation in 2025 is to build on the past two years of outstanding results and again deliver profitable growth while strengthening our brands and operating model."

The company warned about the impact of higher freight and capital costs. Additionally, it expects a $5 million impact from President Trump's tariffs, Reuters reported.

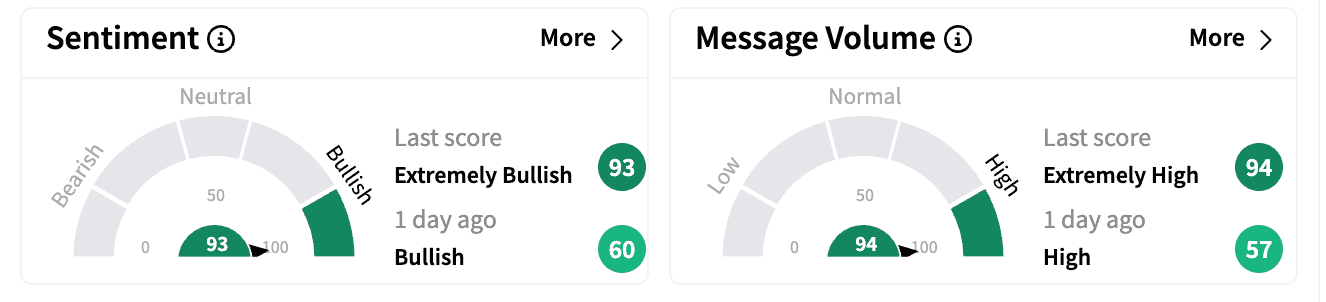

Sentiment on Stocktwits improved to 'extremely bullish' from 'bullish' a day ago. Message volume climbed to 'extremely high' from 'high.'

One trader was waiting for the stock to touch $85.

Another suggested that patience is key.

The Fly reported that Jefferies lowered the firm's price target to $170 from $220 with a 'Buy' rating. The firm flagged concerns about negative February trends at the company's flagship Abercrombie brand, carryover inventory, and markdowns.

Abercrombie stock is down 41% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)