Advertisement|Remove ads.

Adani Power Shares Rally: Here Are Three Big Reasons Behind The Move

Adani Power’s shares surged nearly 14% on Friday, amid a series of events that are likely to result in further upside.

SEBI Clean Chit

Securities and Exchange Board of India (SEBI) gave a clean chit to the Adani Group in a high-profile case triggered by US-based short-seller Hindenburg Research.

The capital markets regulator’s final orders dismissed allegations of stock manipulation, fund diversion, and accounting irregularities, bringing closure to an investigation that had weighed heavily on investor sentiment for over two years.

Hindenburg had accused the conglomerate of inflating stock prices, misusing offshore entities, failing to disclose norms, and engaging in dubious related-party transactions in a report released in January 2023. The claims sparked a significant erosion in market value across Adani’s listed companies

SEBI concluded that the allegations were not substantiated. The regulator observed that loans flagged in the Hindenburg report had been fully repaid with interest before the probe began.

Adani Enterprises rose as much as 7.3% while Adani Ports gained 3.3%.

Bullish Brokerage Report

Global brokerage firm Morgan Stanley initiated coverage on Adani Power with an “overweight” rating and a target price of ₹818 per share.

According to the MS report, Adani Power is India’s largest private coal-based independent power producer, with a portfolio of 18,150 MW across 12 plants in eight states. Its current market share in coal capacity and thermal generation stands at 8%, and Morgan Stanley projects that it will grow to 15% by FY32, helped by expanding its capacity to 41.9 GW, or about 2.5 times its FY25 levels.

Morgan Stanley further forecasts that Adani Power’s earnings (EBITDA) could triple by FY33, driven by the execution of its large capacity additions, favourable regulatory resolutions, and improved procurement and logistics operations.

Stock Split

Adani Power will conduct its first-ever stock split in a 1:5 ratio, reducing the face value of each share from ₹10 to ₹2. The company has set September 22 as the record date, making September 19 the last trading day for eligibility.

The move is aimed at boosting liquidity and encouraging greater retail participation in the stock.

Stock Overview

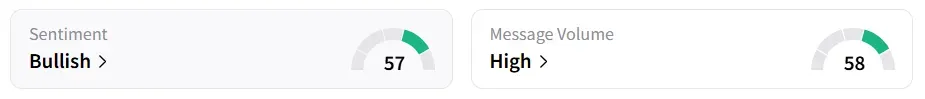

Amid ‘high’ retail chatter, sentiment for Adani Power on Stocktwits flipped to ‘bullish’ from ‘bearish’ in the previous session.

Year-to-date, the stock has gained more than 35%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262983094_jpg_2896f12e4a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)