Advertisement|Remove ads.

Adeia’s Stock Crashed 24% Today To Dip Below 200-DMA For First Time Since Early August: What’s Driving The Decline?

- Adeia Inc. slashed its revenue and net income outlook for FY2025.

- The company filed patent infringement lawsuits against AMD.

- The lawsuit pertains to the alleged infringement of 10 semiconductor patents.

Shares of Adeia Inc. (ADEA) slumped nearly 24% in early trade on Monday, and are on track to record their sharpest intraday decline in over five years. The stock has fallen below its 200-day moving average (DMA) on Monday for the first time since early August.

The company has slashed its FY2025 revenue and net income outlook, citing the possibility of not proceeding with a license agreement with AMD. The company has revised its revenue expectations to $360 million to $380 million, down from its earlier guidance of $390 million to $430 million. Net income projections have been reduced to $52.4 million to $71.6 million, compared to the previous range of $85.1 million to $86.5 million.

“While we still have paths to achieve our original revenue guidance range for the year, we have taken a prudent approach and adjusted our 2025 full-year guidance primarily to reflect that the license agreement we had been pursuing with AMD is now unlikely to close in the fourth quarter of this year as we had previously expected,” said Paul E. Davis, CEO of Adeia.

While Adeia’s Q3 revenue improved marginally to $87.3 million, net income more than halved to $8.8 million.

Lawsuit Against AMD

Earlier on Monday, Adeia filed patent infringement lawsuits against Advanced Micro Devices, Inc. (AMD) in the U.S. District Court for the Western District of Texas. The company claims that AMD has violated 10 of its semiconductor patents, including seven related to hybrid bonding technology and three related to advanced process node technology.

How Did Stocktwits Users React?

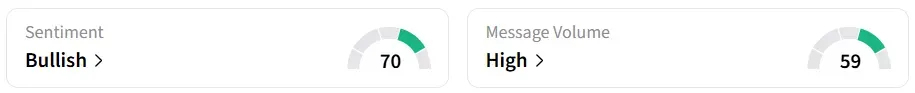

Despite the significant intraday decline, retail sentiment on Stocktwits remained within the ‘bullish’ territory over the past day while message volume rose to ‘high’ level from ‘neutral’.

The shares have fallen around 4% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)