Advertisement|Remove ads.

Advance Auto Parts Gets Multiple Price Target Hikes, But Truist Wonders If The Stock Is Worth 50% More: Retail’s Extremely Bullish

Shares of Advance Auto Parts Inc. (AAP) traded over 3% lower on Friday afternoon after a massive rally on Thursday following upbeat earnings. The stock witnessed multiple price target hikes from brokerages on Friday.

Adjusted and diluted loss per share for the quarter came in at $0.22, compared with a profit of $0.33 recorded in the corresponding quarter of 2024, but below an expected loss of $0.62.

The company also reaffirmed its full-year guidance, including adjusted EPS between $1.5 and $2.5, despite tariff-related uncertainty.

Goldman Sachs raised its price target on AAP to $48 from $43 and said that it believes the stronger performance during the quarter indicates the management’s turnaround efforts are beginning to take hold.

Advance Auto Parts closed more than 500 corporate locations in the quarter as part of its store optimization program and opened 10 new ones, resulting in 4,285 stores as of the end of the quarter.

Goldman Sachs noted that auto parts retail remains a very solid industry with potentially better emerging trends, especially in pricing.

Truist, meanwhile, increased its price target on AAP to $51 from $34 while keeping a ‘Hold’ rating on the shares.

Truist said that although Q1 was better than expected, it is not certain whether the company is worth 50% more. The brokerage added that it would "prefer to see more than a single [quarter] of better performance to get more constructive" on the stock.

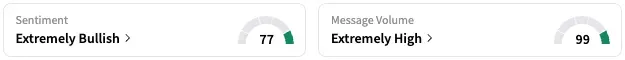

On Stocktwits, retail sentiment about AAP stayed within the ‘extremely high’ territory over the past 24 hours while message volume remained unmoved at ‘extremely high’ levels.

AAP stock is down by over 1% this year and about 32% over the past 12 months.

Read Next: Treasury Secretary Bessent Expects Trade Deals Before 90-Day Pause Ends

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)