Advertisement|Remove ads.

Advance Auto Parts Stock Soars Pre-market On Upbeat Q1 Earnings: Retail Expects Rally Toward $45 Mark

Shares of Advance Auto Parts, Inc. (AAP) shot up 33% in pre-market trading on Thursday after the company reported upbeat first-quarter (Q1) earnings and reaffirmed its annual guidance despite tariff-related uncertainty.

The company reported first-quarter net sales of $2.6 billion, compared with $2.8 billion in the first quarter of the prior year, and above an analyst estimate of $2.51, as per Finchat data.

Advance Auto Parts closed more than 500 corporate locations in the quarter as part of its store optimization program and opened 10 new ones, resulting in 4,285 stores as of the end of the quarter.

Adjusted and diluted loss per share for the quarter came in at $0.22, compared with a profit of $0.33 recorded in the corresponding quarter of 2024, but below an expected loss of $0.62.

The company, however, reaffirmed its annual guidance despite the impact of recent tariffs introduced by the Trump administration.

CEO Shane O'Kelly said that the tariffs have created a highly dynamic economic environment, but the company stays focused on turnaround. Its annual guidance assumes that current tariffs will remain in place for the entirety of the year.

The firm expects full-year revenue between $8.4 billion and $8.6 billion and adjusted EPS between $1.5 and $2.5. It is also planning to open 30 new stores this year.

Earlier this year, the company said it is targeting net sales of about $9 billion in fiscal year 2027.

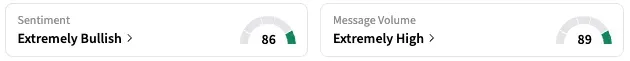

On Stocktwits, retail sentiment around AAP jumped from ‘bearish’ to ‘extremely bullish’ territory over the past 24 hours while message volume jumped from ‘high’ to ‘extremely high’ levels.

A Stocktwits user expressed optimism that the stock will touch $45.

AAP stock is down by about 35% this year and 55% over the past 12 months.

Also See: Railroad Operator CSX Sees Rise In Industrial Development Following Trump Tariffs

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/incyte_resized_jpg_4f94b32a2f.webp)