Advertisement|Remove ads.

After 20% Fall, Sona BLW Eyes Recovery: SEBI RA Sees Upside To ₹550

After facing heavy selling pressure earlier this year, Sona BLW Precision Forgings (Sona Comstar), a manufacturer of automotive systems and components, is showing signs of recovery.

The stock had shed nearly 20% this year, but a recent spike has seen it gain nearly 6% over the past week. It was trading 0.9% lower at ₹480.50 at the time of writing.

Sona Comstar stock has formed a decisive bullish engulfing candle on high volume, closing above the key resistance zone of ₹470 - ₹475, said SEBI-registered analyst Vijay Kumar Gupta.

This move was supported by the highest volume in months (21.15 million shares), indicating strong institutional buying interest.

Momentum indicators, including commodity channel index (CCI), have jumped to +22.03 from oversold levels, suggesting a trend transition, while on-balance volume (OBV) has sharply reversed course after a prolonged decline, the analyst noted.

The price has also reclaimed the Tenkan-sen and is approaching the Ichimoku cloud, he added. A breakout above the cloud resistance at ₹490 - ₹495 will strengthen the bullish bias.

The analyst recommends monitoring the weak swing high at ₹502.50, which could act as the next technical hurdle. A close above this level could open up upside potential toward ₹530 - ₹550. Key levels to watch include immediate support at ₹455 and resistance at ₹485 - ₹502.5, Gupta added.

On the fundamental side, renewed optimism around EV component suppliers is driving sentiment. Market chatter around supply chain ramp-ups in India and Europe has reignited interest in Sona Comstar.

In its latest earnings call, the management emphasized a strong order book in powertrain and EV-related segments. A sectoral rotation into auto-ancillaries, ahead of the festive season and export cycle tailwinds, is also providing additional support.

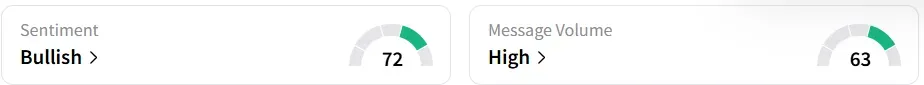

Retail sentiment on Stocktwits was ‘bullish’, amid ‘high’ message volumes.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)