Advertisement|Remove ads.

Against The Odds, Homebuilder Stocks Climb As Incentives Offset Housing Market Gloom: DR Horton, PulteGroup Pop

Upbeat quarterly results from home builders D.R. Horton (DHI) and PulteGroup (PHM) on Tuesday showed that buyer incentives and rebates were helping drive home sales in what continues to be a challenging market, weighed by high inflation and economic uncertainty.

Shares of D.R. Horton, the largest homebuilder by volume in the U.S., rose 17%, their largest intraday gains in over five years, to close at their highest level this year. PulteGroup shares gained 11.5%, also hitting a 2025 high.

Both companies reported revenue declines that were less-than-feared by Wall Street analysts, although their heads indicated that the incentive programs were weighing down margins.

D.R. Horton CEO Paul Romanowski said new home demand remains weak, and expects "incentives to remain elevated and increase further during the fourth quarter."

The company's Q3 revenue fell 7.4% to $9.23 billion, compared with analysts' estimate of $8.76 billion. The management indicated that gross margins would decrease to 21% to 21.5% in the current quarter, from 21.8% in the third quarter.

D.R. Horton also narrowed its annual consolidated revenue forecast range to between $33.7 billion and $34.2 billion from its earlier forecast of $33.3 billion to $34.8 billion.

PulteGroup CEO Ryan Marshall said consumers faced "a range of issues from high interest rates and challenged affordability to macro concerns about the strength of the economy" during the 2025 spring period.

The company's Q2 revenue fell 4.3% to $4.40 billion, but was still ahead of expectations of $4.39 billion.

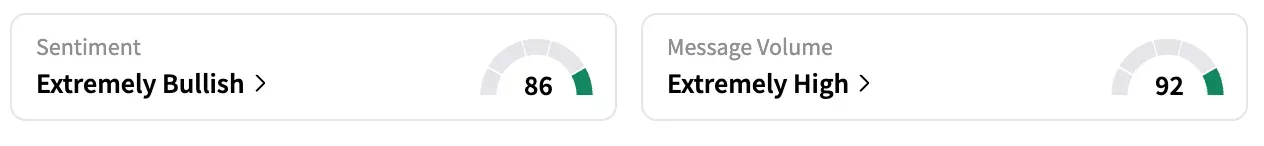

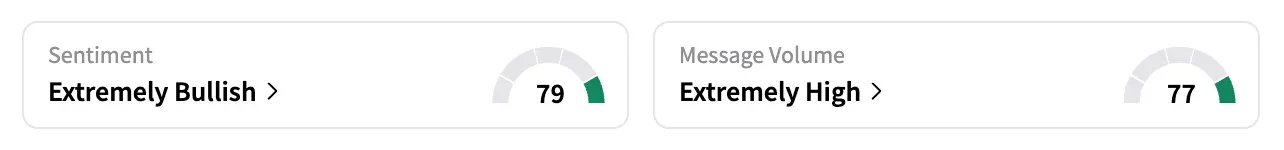

On Stocktwits, the retail sentiment for both D.R. Horton and PulteGroup was 'extremely bullish' as of early Wednesday.

As of their close on Tuesday, DHI stock is up nearly 10% year-to-date, while PHM stock is up 11.3%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Donald Trump, Amazon's Jeff Bezos Reportedly Met At White House Last Week, Signaling Growing Ties

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231498932_jpg_bdd44fc548.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_AEHR_chip_maker_3698bf2343.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205870269_jpg_b38339787f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altimmune_jpg_8f251e2911.webp)