Advertisement|Remove ads.

Retail Goes Gaga Over Inuvo Shares On Upbeat Q2 Outlook, Reverse Stock Split Plans

Shares of AI-based ad tech company, Inuvo Inc.(INUV), shot up 11% on Thursday morning, after the company reaffirmed its outlook for revenue performance in the second quarter of 2025.

The firm expects year-over-year (YoY) revenue growth of at least 25%, continuing a trend of strong performance.

The company also finalized a 1-for-10 reverse stock split of its outstanding common shares, a move previously approved by shareholders during the annual meeting on May 22.

The decision aims to enhance the stock’s appeal to a broader base of institutional investors and improve its overall liquidity.

“Following two consecutive record-breaking quarters, we believe this strategic action will make our stock more accessible to institutional investors, many of whom are restricted from purchasing stocks trading below certain thresholds,” said CEO Richard Howe.

Inuvo’s proprietary, patented IntentKey AI platform identifies and responds to the underlying motivations behind consumer interest in products, services, or brands without relying on personal identity data.

Designed to overcome advertising challenges like privacy restrictions and signal loss, it supports both self-service and managed options.

The platform targets the $ 200 billion+ ad tech market with features such as instant audience building, five-minute trend updates, and detailed demographic insights.

For the first quarter, Inuvo’s revenue jumped 57% YoY to $26.7 million, beating the analysts' consensus estimate of $23.68 million, as per Finchat data.

Net loss per share of $0.01 also beat the consensus estimate of $0.13.

During Q1, Inuvo launched the enhanced IntentKey Self-Serve Platform. The company added 20 new IntentKey clients and now has 15 self-service clients.

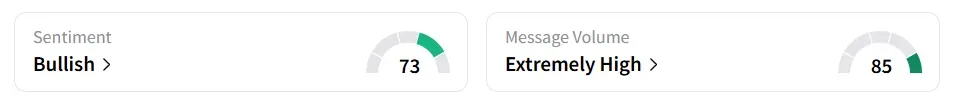

On Stocktwits, retail sentiment around Inuvo remained in ‘bullish’ territory.

Inuvo stock has gained fivefold in 2025 and over tenfold in the last 12 months.

Also See: Wall Street Boosts Oracle Price Target After Upbeat Q4, But Along Comes A Word Of Caution

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ford_jpg_186fb0eaa9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2237643016_jpg_17a9a7eb9d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221557373_jpg_2cb3ed82cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bulls_versus_bears_stock_market_jpg_c083ddc168.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2251311021_jpg_31a407e714.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_aluminum_resized_jpg_6efa759339.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)