Advertisement|Remove ads.

Airbnb Sees Softer Q2 Bookings As Economic Uncertainty Deters US Travelers: Retail Turns Extremely Bearish

Airbnb (ABNB) flagged weakness in the hospitality sector and forecast second-quarter revenue below Wall Street expectations on Thursday.

Shares of the company dropped over 5% in extended trading after the results.

President Donald Trump's trade policy, which has raised the probability of a recession in the U.S., is affecting the behavior of travelers and vacationers.

Given the uncertainty, Airbnb said guests were booking trips closer to the check-in date.

Airline operator Delta Air Lines (DAL) and Hotel chain Hilton (HLT) have previously indicated that demand has weakened and consumers are in a wait-and-watch mode.

Airbnb said it expects second-quarter revenue of $2.99 billion to $3.05 billion, which is largely below the $3.04 billion analyst estimate from LSEG/Reuters.

It expects the average daily rate, or the rental revenue earned for an occupied room per day, to remain flat and the core profit margin slightly down from a year earlier.

Revenue rose 6% to $2.27 billion in the first quarter, slightly above the estimated $2.26 billion.

However, net income slumped 41.7% to $154 million due to various factors, including higher staff costs, write-downs of certain historical investments, and lower interest income.

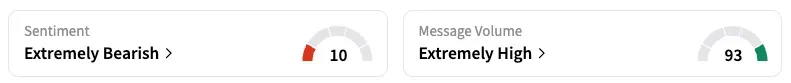

On Stocktwits, retail sentiment plummeted to 'extremely bearish' from 'bearish' the day before, while message volume rose to 'extremely high.'

In a lighter vein, a user said they knew the stock would underperform as soon as Ark Investment CEO Cathie Wood bought Airbnb shares.

Wood is infamously known to have sold a big position in Nvidia in 2023, just before a massive AI-driven rally in the server company's shares.

Another user noted the "very quiet and super bearish" tone of the company.

Airbnb stock is down 5.6% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_dow_jones_jpg_e152f04aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_job_seekers_florida_resized_jpg_742e535d49.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Altcoins_ff3521c963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_credo_technology_resized_cdb4311141.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)