Advertisement|Remove ads.

Retail Investors Pile Into Little-Known AI Stock That’s Up 131% This Year

Airship AI Holdings Inc. (AISP) has become the talk of the town among retail investors, with its stock price skyrocketing and message volumes on Stocktwits surging by a staggering 3500% in just one week.

The company, which specializes in video analysis software for law enforcement and defense, saw its shares jump 18% in after-hours trading on Monday after withdrawing its proposed sale of 2.14 million common shares.

AISP’s stock price has soared 131% year-to-date, largely driven by a big contract with a Department of Justice agency for its Acropolis Enterprise Sensor Management platform.

The move to pull the stock offering has fueled speculation among retail investors that another major contract could be in the pipeline.

The company went public in December 2023 through a SPAC deal and is trading on the Nasdaq with a market cap of roughly $85 million.

Despite its relatively low profile, Airship AI has reportedly been in operation for nearly two decades, providing video analysis solutions to government agencies.

On Tuesday, AISP shares continued to rise, up 3.64% to $3.70, as retail investor enthusiasm remained high.

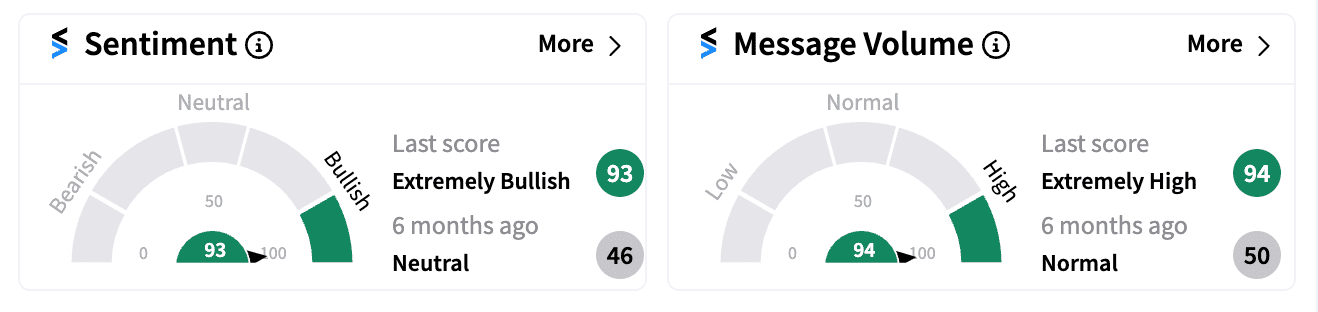

With Stocktwits sentiment at an extremely bullish level (93/100) and message volumes at a record high, it's clear that investors are keen on this small-cap AI play.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_bitcoin_red_resized2_4b1c608f3a.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218096576_jpg_5f8f72424d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_eli_lilly_logo_resized_9e8a8a2333.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sunrun_resized_78420391c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2216742392_jpg_6f9d355647.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Ram_83262cba1d.jpg)