Advertisement|Remove ads.

Alaska Air Warns Q3 Earnings To Hit Low End Of Forecast Amid Rising Fuel Costs, Summer Disruptions

Alaska Air (ALK) said on Monday that it expects third-quarter adjusted earnings per share (EPS) to be at the lower end of its previously guided range of $1 to $1.4, primarily due to elevated fuel costs and operational challenges during the summer.

The company said that these factors have pressured unit costs, with West Coast refining margins remaining high due to ongoing refinery disruptions, pushing its expected economic fuel price to $2.50 - $2.55 per gallon, up from the prior expectation of about $2.45.

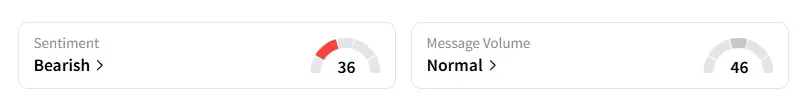

Shares of Alaska Air were down nearly 2% in premarket trading on Monday. Retail sentiment on the stock remained unchanged in the ‘bearish’ sentiment, with message volumes at ‘normal’ levels, according to data from Stocktwits.

Alaska Air said that irregular operations, including weather and air traffic control issues, resulted in increased costs from overtime, premium pay, and passenger compensation. The company added that the July IT outage continues to carry an expected $0.10 earnings per share impact, now weighted more heavily toward cost than revenue as originally contemplated.

In late July, Alaska Air had to ground its aircraft due to a system-wide IT issue. However, operations were resumed within a few hours.

Alaska Air said that despite these pressures, revenue trends remained strong and unit revenue was tracking near the high end of its prior guidance range of flat to low-single-digit growth. The company added that yields turned positive year-over-year in August, driven by premium cabin strength and a double-digit rebound in corporate revenue since the second quarter of 2025.

The carrier added that its third-quarter book tax rate is expected to be about 30% while cash taxes remain negligible, consistent with prior expectations.

Shares of Alaska Air have declined over 2% this year and gained more than 53% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: California Resources, Energy Company Berry To Merge In An All-Stock Deal

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740483_jpg_28cc9c7ce9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)