Advertisement|Remove ads.

Alexander & Baldwin Shares Shoot Through The Roof After $2.3B Take Private Deal – This Firm Has Downgraded The Stock

- Piper Sandler downgraded ALEX stock to ‘Neutral’ from ‘Overweight’ and kept the price target unchanged at $21.

- Alexander & Baldwin announced on Monday that it would go private in a deal worth $2.3 billion.

- The company will be acquired by a MW Group joint venture for $21.20 per share by the first quarter of 2026, the company said in a statement.

Shares of Alexander & Baldwin (ALEX) rallied over 38% on Tuesday morning after the announcement of the $2.3 billion take-private deal.

The company’s outstanding shares will be acquired at $21.20 per share by a joint venture formed among MW Group, Blackstone Real Estate, and DivcoWest, expected to close by the first quarter of 2026. The all-cash deal represents a 40% premium to the company’s closing price as of Dec. 8, 2025.

In addition, Alexander & Baldwin announced a fourth-quarter (Q4) 2025 dividend of $0.35 per share, payable on January 8, 2026.

Street Action

Meanwhile, Piper Sandler downgraded ALEX to ‘Neutral’ from ‘Overweight’ before, while keeping the price target intact at $21, as cited on TheFly. Piper said that it has revised its rating following the announcement and does not expect a competing bid to emerge.

“Today, we are taking an important step toward our long-term vision for A&B as stewards of Hawai'i's premier commercial real estate. As a private company supported by the deep real estate expertise and experience of our new ownership group, A&B will have greater capacity to serve its tenants and communities,” President and CEO Lance Parker said.

Alexander & Baldwin is the only publicly traded real estate investment trust focused solely on Hawaiian commercial real estate. The company owns about four million square feet of commercial space in Hawai'i.

How Did Stocktwits Users React?

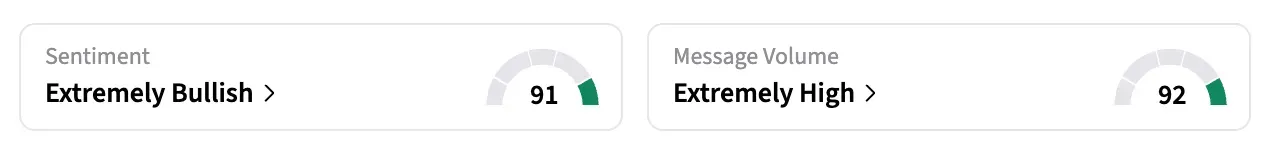

On Stocktwits, retail sentiment around ALEX jumped from ‘neutral’ to ‘extremely bullish’ territory over the past 24 hours, while message volume rose from ‘high’ to ‘extremely high’ levels.

Shares of ALEX have climbed over 18% in the past year and returned almost 30% in the last five years.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)