Advertisement|Remove ads.

Alibaba Targets $1.5B From Bond Sale Linked To Health Arm: Retail’s Byuoant

Chinese technology giant Alibaba Group Holding Ltd. (BABA) announced on Thursday plans to raise roughly HK$12 billion ($1.53 billion) through a private bond issuance tied to shares of its healthcare arm, Alibaba Health Information Technology Limited.

The company aims to bolster its strategic investments in cloud services and cross-border e-commerce through this move.

Following the news, Alibaba stock traded 2.5% lower in Thursday’s premarket session.

The bond deal will be offered to select offshore investors under Regulation S and will not accrue interest over its term. It will mature in 2032 and can be converted into Alibaba Health shares, cash, or a mix of both.

Starting 41 days after issuance, holders will have the flexibility to convert the bonds into Alibaba Health shares at any time before the last five trading days leading up to maturity.

Final exchange pricing and terms will be finalized during the bond pricing phase.

Alibaba holds approximately 64% ownership in Alibaba Health, which will continue to operate as a consolidated subsidiary following the bond issuance and any future conversions.

According to a Reuters report, by linking the bonds to its healthcare arm, Alibaba appears to be leveraging its assets without diluting core business operations.

The fundraising effort comes months after the company's $5 billion dual-currency issuance in November 2024, a record-setting deal in the Asia-Pacific bond market at the time.

Although widely recognized for its dominance in e-commerce, Alibaba has been swiftly expanding its initiatives in artificial intelligence. CEO Eddie Wu recently stated that the company’s primary objective is now the development of artificial general intelligence capable of mimicking human cognition.

The company also disclosed its intention to invest at least RMB 380 billion (approximately $53 billion) over the next three years to enhance its cloud infrastructure and AI capabilities.

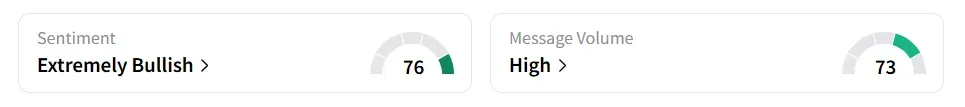

On Stocktwits, retail sentiment toward Alibaba improved to ‘extremely bullish’ from ‘bullish’ territory the previous day amid ‘high’ levels of message volume.

Alibaba stock has gained over 30% year-to-date and over 46% in the past 12 months.

(Exchange Rates:

1HKD = 0.13USD

1RMB = $0.14USD )

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)