Advertisement|Remove ads.

Alibaba’s Qwen-3 Coder Takes Aim At OpenAI’s GPT-4, Anthropic’s Claude In Code Generation Battle

Alibaba Group (BABA) has announced Qwen3-Coder, its latest generative artificial intelligence model, which it claims is the most advanced for code generation.

The Chinese tech giant has stepped up the competition this year with a rapid rollout of AI under its Qwen family of large language models (LLMs). Its latest offering puts Qwen in direct competition with tools like Microsoft's GitHub Copilot and Google's Gemini Code Assist.

Alibaba said the Qwen3-Coder open-source model outperformed domestic competitors, such as models from DeepSeek, and matched the performance of leading U.S. models, including Anthropic's Claude and OpenAI's GPT-4 in certain areas.

The model is particularly proficient in coding related to agentic AI, software that can accomplish digital tasks, according to a statement on Wednesday.

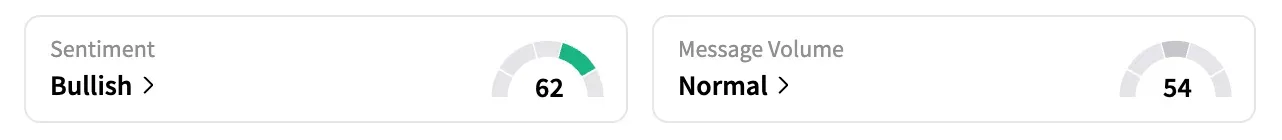

On Stocktwits, the retail sentiment for Alibaba held in the 'bullish' zone, unchanged from a week ago.

The development underscores a broader momentum in China's tech sector, which is rapidly advancing AI to compete with Western counterparts. Startup DeepSeek gained attention early this year for its low-cost models, while Baidu's Ernie Bot has already attracted millions of users.

While Alibaba has benefited from its rapid rise in AI, fierce competition in China's food delivery market has been a drag for the company. Heavy investment in expanding its Ele.me service to take on Meituan and newcomer JD.com (JD) has cost the company billions and weighed on its stock in recent months.

Alibaba's U.S.-listed shares, BABA, are down 17% from their recent high in March. Overall, the stock is up about 42% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Amazon Joins Wearable AI Race, Acquires Bee’s Chat-Summarizing Wristband

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247874160_jpg_4fb51355e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_verastem_jpg_8ed70d9d9a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_with_others_OG_jpg_86ee42eaf9.webp)