Advertisement|Remove ads.

Alphabet Stock Gets Price Target Boost Ahead Of Q2 Earnings: Retail Chatter Spikes

Alphabet Inc.(GOOGL) (GOOG) received a pair of price target increases from Wall Street analysts ahead of its second-quarter (Q2) earnings report, reflecting renewed optimism about the digital advertising space.

Following the price target hikes, Alphabet stock inched 0.3% higher on Tuesday afternoon.

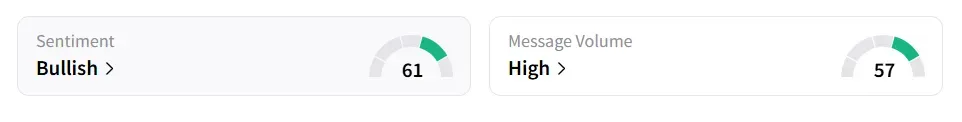

On Stocktwits, retail sentiment around the stock remained in ‘bullish’ (62/100) territory, while message volume shifted to ‘high’ (57/100) from ‘normal’ levels in 24 hours.

Alphabet’s message count experienced a 313% surge in the last 24 hours.

A user stated that although earnings will be good, the market may not like the outlook.

Stifel raised its target price on Alphabet shares to $218 from $200, while maintaining a ‘Buy’ rating, according to TheFly.

The firm noted that although April started slowly, performance improved throughout the quarter, with June emerging as the strongest month.

Still, Stifel doesn't anticipate a significant market reaction following the earnings release.

Bernstein also lifted its price target on Alphabet to $195 from $185, maintaining a ‘Market Perform’ rating. Despite earlier headwinds in 2025, the brokerage noted that sentiment across the internet sector has become more constructive as earnings season approaches.

Bernstein noted that the digital ads landscape appears stable, with robust industry checks, although it warned of some weakness among Chinese retailers impacted by tariff adjustments.

While Stifel sees potential upside in Alphabet’s numbers, it favors taking long positions in Meta Platforms Inc. (META) and The Trade Desk Inc. (TTD) as preferred picks within the digital ads group.

Bernstein, on the other hand, named both Alphabet and Pinterest Inc. (PINS) as tactical longs this quarter.

These revisions come as Wall Street recalibrates expectations for tech and internet firms amid a backdrop of rising digital ad spending, AI-driven targeting capabilities, and signs of recovery from earlier macroeconomic uncertainty.

According to Fiscal AI data, analysts expect Alphabet’s Q2 revenue to be $93.95 billion and the earnings per share (EPS) of $2.19.

Alphabet stock has added 0.7% in 2025 and over 4% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)