Advertisement|Remove ads.

Alphabet Stock Outperformed Mega-Cap Tech Peers In Q3, Thanks To 38% Quarterly Jump — Best In Nearly 2 Decades: But Retail Holds Off

Alphabet shares posted their strongest quarterly gain in two decades, driven by the company’s noteworthy progress in artificial intelligence (AI) technology and a relief from a milder-than-expected antitrust ruling.

Quietly, the Google parent is reclaiming its place as one of the top AI companies, after initial missteps, amid a challenging landscape that includes OpenAI, Microsoft, Apple, Chinese tech giants such as Alibaba and Baidu, and dozens of startups.

Alphabet's Class A shares rose 38.1% in the three months ended September, their biggest such gain since mid-2005. Among the so-called Magnificent Seven stocks, the performance was second only to Tesla's 40% gains in the quarter.

Alphabet's rally came as a court decision in the long-running Department of Justice's antitrust case against Google stopped short of the harshest remedies regulators had pushed for, such as forcing the company to divest its Chrome browser.

Meanwhile, the search giant's second-quarter results in July showed rising demand for AI tools driving revenue growth.

Alphabet is well-positioned to benefit from AI across advertising and the cloud, and Google's AI-infused ad business "has significant room to run," Mizuho stated, as it initiated coverage on Alphabet with an 'Outperform' rating earlier this week.

Currently, an overwhelming majority of 54 of the 65 analysts covering Alphabet stock rate it 'Buy' or higher, and 11 rate it 'Hold,' according to Koyfin data. However, their average price target of $239.33 implies a 1.6% downside for the stock.

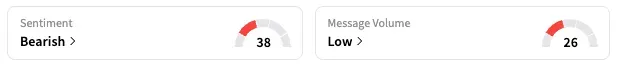

On Stocktwits, the retail sentiment for GOOGL was 'bearish' as of the last reading. Year-to-date, the shares are up 27.5%, outperforming the 13% gain for the SPDR S&P 500 ETF Trust.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Apple Denies Favoritism To OpenAI, Breach Of Antitrust Rules In Musk's Lawsuit

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239226376_jpg_c72fd10c8b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_App_Lovin_jpg_42d40549b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)