Advertisement|Remove ads.

Alphabet Stock Pulls Back From Record Highs After Slight Q4 Revenue Miss: Retail Swoops In To Buy The Dip

Alphabet, Inc. (GOOGL) (GOOG) shares pulled back in Wednesday’s after-hours session after the search giant reported a slight revenue miss, with cloud revenue trailing expectations.

Mountain View, California-based Alphabet reported fourth-quarter earnings per share (EPS) of $2.15, exceeding the $2.13 consensus estimate. Revenue climbed 12% year over year (YoY) to $96.47 billion versus the average analysts’ estimate of $96.68 billion.

Google advertising revenue, accounting for 75% of the total, improved 10.6% YoY to $72.46 billion, with Google Search & other revenue rising 12.5% to $54.03 billion and YouTube ad revenues improving 13.8% to $9.2 billion.

Google Cloud revenue jumped 30% to $9.19 billion, and yet trailed expectations. Wedbush analyst Scott Devitt had modeled 32.3% growth for this business. Among rivals, Microsoft Corp.’s (MSFT) December quarter Azure revenue increased 31%.

Google Services generated an operating income of $32.84 billion and Google Cloud $2.09 billion, improving 22.8% and 142%, respectively.

Alphabet CEO Sundar Pichai said, “Q4 was a strong quarter driven by our leadership in [artificial intelligence] AI and momentum across the business.”

The executive noted that the company’s advances like AI Overviews and Circle to Search are increasing user engagement in its Search business and its AI-powered Google Cloud portfolio is seeing stronger customer demand, and YouTube continues to be the leader in streaming watch-time and podcasts.

Cloud and YouTube exited 2024 at an annual run rate of $110 billion.

“We are confident about the opportunities ahead, and to accelerate our progress, we expect to invest approximately $75 billion in capital expenditures in 2025,” Pichai added.

Speaking on the earnings call, new CFO Anat Ashkenazi said the company expects headwinds from having one less day of revenue in the first quarter and also from adverse forex impact. She also flagged tougher comparisons impacting the Google Services advertising revenue as the company experienced strength in the financial services vertical throughout 2024.

Following the quarterly print, Citi analysts reduced the price target for Alphabet stock to $229 from $232 but maintained a ‘Buy’ rating, TheFly reported.

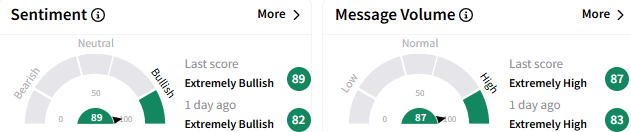

On Stocktwits, sentiment toward Alphabet stock stayed ‘extremely bullish’ (89/100) accompanied by ‘extremely high’ message volume. The stock was among the top five trending tickers on the platform.

Undeterred by the stock retreat, retail investors signaled that they would buy the dip.

Another user suggested that either the Search or Cloud business would fire and that Alphabet is cheap, considering the 30% Cloud growth with $75 billion in capital expenditure.

In premarket trading, Alphabet stock fell 7.10% to $191.72, retreating from Tuesday's all-time closing high of $206.38. The stock has gained 9% this year following a 31% jump in 2024.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228900989_jpg_e94daec744.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2238161001_jpg_d763653491.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202902434_jpg_34a840ada1.webp)