Advertisement|Remove ads.

AlphaTON Deploys Nvidia Blackwell Chips To Boost AI Revenue Amid Share Sale Announcement

- The company is planning an hourly rental of the B200s to AI developers, enterprises, and the Telegram ecosystem.

- AlphaTON said that it estimates the chips would generate an average revenue of between $4 to $6 per hour for AI deployment.

- Earlier on Tuesday, the company announced an at-the-market offering agreement with H.C. Wainwright & Co. to sell up to $400 million of its ordinary shares.

AlphaTON Capital Corp. (ATON) on Tuesday announced a compute infrastructure lease agreement with NVIDIA Corp. (NVDA) to install the latter’s Blackwell B200 chips across its Canadian facilities.

The deployment of Nvidia’s GPUs, expected to be delivered later this week, will add to AlphaTON’s artificial intelligence revenues, the company said.

Earlier on Tuesday, the company announced an at-the-market offering agreement with H.C. Wainwright & Co. to sell up to $400 million of its ordinary shares from time to time.

Shares of ATON declined more than 7% at the time of writing, trimming earlier losses following the share sale announcement.

The Nvidia Deal

The $30 million agreement to deploy 504 NVIDIA B200 chips across its facilities in Canada will scale its AI revenue, expected to provide a 1.7x return multiple and 40% internal rate of return (IRR), AlphaTON said in a statement.

This would amount to a minimum of $1.2 million in monthly revenues, expected to begin in March 2026 with the hourly rental of B200s to AI developers, enterprises and the Telegram ecosystem, the company said.

The company estimates that the B200 chip would generate an average revenue of between $4 to $6 per hour for AI deployment, and the 504 chips rented out for a month would generate an estimated $1.45 million in revenues. With the company’s 1,080 B200 and B300 chips expected to be fully usable by April 2026, AlphaTON projects monthly revenue of $3.11 million.

Amid surging AI infrastructure spending by big tech companies and growing national-security priorities, AlphaTON CEO Brittany Kaiser said that many AI workloads cannot run on Big Tech platforms due to privacy, sovereignty, and data protection constraints.

Earlier in January, the company acquired a 576 NVIDIA B300 GPU half-cluster scheduled for delivery in March 2026 for $46 million, supported by a five-year colocation agreement with atNorth AB in Sweden.

In Nov. 2025, the company deployed its first pilot fleet of B200s to Telegram's Cocoon AI network that delivered a 340% month-over-month growth in inference requests since launch, the company said.

Share Sale

Before announcing the latest deal with Nvidia, AlphaTON said in a filing with the U.S. Securities and Exchange Commission that it had entered into an at-the-market share offering agreement with H.C. Wainwright & Co. to allow it to sell up to $400 million of its ordinary shares from time to time under a previously-filed prospectus and existing Form F-3 shelf registration.

The agreement would allow the company to sell shares from time to time on Nasdaq or through other permitted methods, as per the filing. It would also give AlphaTON and H.C. Wainwright the flexibility to start, pause or terminate sales, and provide the New York-based investment bank up to a 3% commission on gross proceeds of the shares sold.

The company said that it plans to use proceeds from the share sales to fund the development and operations of Cocoon AI, its decentralized AI computing platform built on the TON blockchain and integrated with the Telegram messaging app. This would include Cocoon AI’s servers, GPUs, and infrastructure.

The proceeds would also be used to pursue strategic acquisitions or investments aligned with AlphaTON’s growth strategy, as well as to support its working capital and general corporate needs, it said.

How Did Stocktwits Users React?

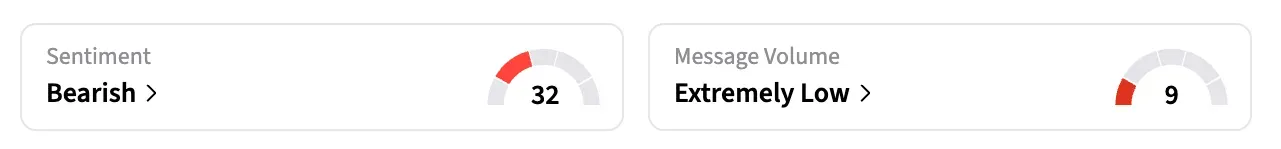

On Stocktwits, retail sentiment around ATON shares remained in the ‘bearish’ territory over the past 24 hours amid ‘extremely low’ message volumes.

One bullish user said that a reversal was coming soon, adding that they expected huge news later this week, and there was no reason to sell shares of the company.

Shares of ATON have declined nearly 90% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also Read: Velo3D Secures $11.5M Defense Contract With Advanced 3D Printing

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HPE_office_with_logo_resized_c15b2ba0d3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_market_fall_generic_jpg_f7dffafa95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201937_jpg_67aaff68c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213366819_jpg_3e8b649e98.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_rising_OG_jpg_5f141f956f.webp)