Advertisement|Remove ads.

Altimmune Stock Attracts Strong Retail Buzz As Investors Count Down To 48-Week Data For Its Fatty Liver Treatment

- Retail traders focused on AI-driven biopsy findings and clearer dose-response exuded increased confidence in pemvidutide’s potential.

- Analysts remained divided, with some citing strong MASH resolution and safety, while skeptics questioned differentiation and funding needs.

- Lancet publication and AASLD late-breaker added momentum as Altimmune advanced additional liver-disease programs toward 2026 readouts.

Retail discussion around Altimmune intensified over the weekend as investors looked ahead to the 48-week readout from the company’s IMPACT Phase 2b trial of pemvidutide for metabolic dysfunction-associated steatohepatitis (MASH), expected in the fourth quarter of 2025.

AI-Based Biopsy Analysis Adds Fresh Momentum

Last week, Altimmune released results from an AI-based analysis of liver biopsies from the IMPACT Phase 2b trial. The company reported that 31% of patients in the 1.8 mg pemvidutide arm and 12% in the 1.2 mg arm achieved a 60% reduction in total fibrosis, compared with 8% for placebo. Improvements were also observed in early and advanced fibrosis categories, with reductions in the area of fibrosis exceeding 60% in select patient groups compared with placebo.

Following the analysis, Citizens JMP lowered its price target to $14 and maintained an ‘Outperform’ rating, noting that it looked ahead to the late-breaking oral presentation at the Liver Meeting and the 48-week dataset expected this quarter. UBS maintained a ‘Buy’ rating, while Jefferies reiterated its ‘Buy’ recommendation, viewing pemvidutide as viable after meeting key histology endpoints at 24 weeks.

Mixed MASH Readout In July Still Shapes Sentiment

Altimmune’s June and July update on its 24-week IMPACT Phase 2b results set the tone for the stock this year. The company reported that up to 59.1% of patients on pemvidutide achieved MASH resolution without worsening of fibrosis, compared to 19.1% for the placebo group. However, the endpoint of fibrosis improvement without worsening of MASH did not reach statistical significance.

Despite this, the trial showed reductions in liver fat, inflammation and biomarkers of fibrosis, alongside meaningful weight loss, with up to 6.2% loss in treated patients compared with 1.0% for placebo. Safety remained favorable, with extremely low discontinuations and no drug-related serious adverse events.

Analyst Community Diverges Across The Year

Bullish analysts’ optimism hinged on the drug’s early MASH resolution signal, weight loss trajectory and tolerability. UBS, Stifel, Jefferies and H.C. Wainwright all maintained ‘Buy’ ratings at various points, describing the 24-week results as either differentiated, fast-acting, viable for Phase 3 advancement or supportive of a potential best-in-class profile. Several of these firms highlighted AI-assisted fibrosis reads and non-invasive tests as consistent with anti-fibrotic activity.

Others expressed more skepticism. In October, Citizens JMP cut its target earlier, while still keeping an ‘Outperform’ rating. Goldman Sachs resumed coverage with a ‘Sell’ rating, citing a lack of meaningful differentiation in obesity and MASH. Concerns about the company’s ability to fund a full Phase 3 program, especially after the mixed fibrosis outcome, were noted among analysts.

Peer-Reviewed Boost

Last week, Altimmune said that The Lancet had published the 24-week efficacy and safety data from the IMPACT Phase 2b trial. The data were also selected for a late-breaking oral presentation at The Liver Meeting 2025 hosted by AASLD. Investigators highlighted significant MASH resolution, reductions in liver fat, anti-fibrotic signals and weight loss, reinforcing the drug’s potential to treat patients with moderate to advanced fibrosis.

Stocktwits Users See No ‘Breaks’ Ahead

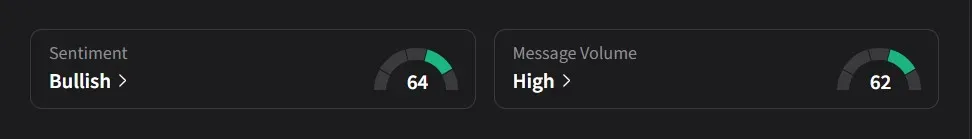

On Stocktwits, retail sentiment for Altimmune was ‘bullish’ amid ‘high’ message volume.

One user discussing the upcoming 48-week dataset pointed to the latest AASLD-published fibrosis odds-ratio findings and the clearer dose-response signals seen in the PathAI-derived analysis, suggesting these results strengthen the case for exploring a higher 2.4 mg dose aimed at accelerating fibrosis reduction, while keeping 1.8 mg and 1.2 mg positioned for broader cardiometabolic use and long-term maintenance.

Another user said, “If 48 week MASH data is ‘BEST IN CLASS’ like the weight loss/muscle sparring data, we should get at least $15B for both…not to mention the other indications.”

A third user said, “48 week should confirm fibrosis improvement and we should race to 2 billion MC on it FAST. no breaks once it’s out.”

Altimmune’s stock has declined 42% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)