Advertisement|Remove ads.

After A Sharp Rally In 2025, Ramaco Is Doubling Down With $100M Share Buyback

- Ramaco will repurchase shares over 24 months.

- It intends to purchase shares with available funds.

- Ramaco had signed an umbrella CRADA with U.S. Department of Energy to accelerate the discovery, mining, processing, and creation of rare earths

Ramaco Resources shares were in the spotlight on Wednesday after its board authorized a share repurchase program of up to $100 million over 24 months, a sign of the firm's strong financial position, even after a sharp rally this year. The announcement sent its shares up more than 6% in premarket trading.

The company intends to purchase shares under the repurchase program opportunistically, using available funds, ensuring sufficient liquidity to fund its capital development program.

“With the closing of Ramaco's previously announced $600-plus million (before fees) in capital raises in the second half of 2025, we are well-positioned. We can now pursue opportunities to unlock value and maximize shareholder returns,” said Randall Atkins, Chairman and CEO of Ramaco.

Strong Demand For Rare Earths Bodes Well For Ramaco

Beyond capital returns, investors are tracking Ramaco’s push into rare earth minerals.

Demand for rare earth minerals has been surging in the United States and globally, as they have become crucial for the production of EV batteries, play a vital role in the global transition to clean energy, and enable advanced defense systems. According to a McKinsey report, global demand for rare earths is projected to triple by 2035.

Ramaco earlier also signed an Umbrella Cooperative Research and Development Agreement (CRADA) with the U.S. Department of Energy's ("DOE") National Energy Technology Laboratory ("NETL"), in a bid to accelerate the discovery, mining, processing, and creation of rare earths and critical minerals and materials at its Brook Mine in Sheridan, Wyoming.

How Did Stocktwits Users React?

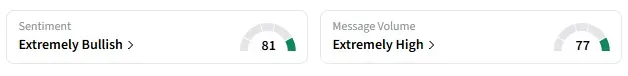

Retail sentiment around METC trended in “extremely bullish” territory amid “extremely high” message volume.

Ramaco Resources' stock has surged more than 57% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)