Advertisement|Remove ads.

Amazon Falls After Price-Target Cuts Compound Fears Of Economic Headwinds Listed By Fed's Powell: Retail Mood Dips

Amazon.com, Inc. (AMZN) shares tumbled nearly 3% on Wednesday, joining a selloff in the broader market, after Federal Reserve Chair Jerome Powell's remarks about the headwinds to businesses and the economy from U.S. trade tariffs.

Powell said he saw a “strong likelihood” that consumers would face higher prices and that the economy would see higher unemployment in the short run.

Speaking for the first time since U.S. President Donald Trump paused some tariffs last week, he said the evolving and “challenging scenario” creates difficulty for the central bank in setting rates.

"For the time being, we are well positioned to wait for greater clarity before considering any adjustments to our policy stance," Powell said in a speech to the Economic Club of Chicago.

The S&P 500 (SPX) ended down 2.2% on Wednesday, bringing the total decline from its February record high to 14%, while the Nasdaq Composite (IXIC) slid 3.1%.

Amazon faces a double whammy: high inflation and consumer prices deter consumers from shopping, especially for discretionary items. Meanwhile, large companies are particularly sensitive to interest rates, which determine their cost of borrowing and future valuation.

Amazon stock, which saw a massive bump last week after Trump paused some tariffs, is still down 28% from its peak this year in February.

Furthermore, two brokerages, BMO Capital and Cantor Fitzgerald, cut their price targets on Wednesday, according to The Fly, further pressuring the shares.

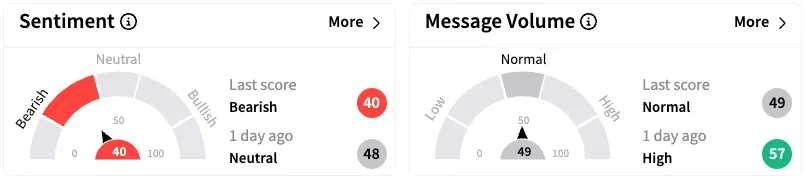

On Stocktwits, retail sentiment dropped to 'bearish' from 'neutral' a day earlier.

However, recent posts from users suggested that many of them considered the current stock price an attractive entry point.

Shares of Amazon are down 20.5% year to date

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)