Advertisement|Remove ads.

Amazon Stock Heads For Yet Another Rough Week — Retail Traders Bearish As Q3 Earnings Day Nears

Amazon.com Inc. shares fell 0.4% in extended trading on Thursday, after a three-session decline, piquing investor interest once again.

The AMZN ticker ranked second on the top trending list on Stocktwits late Thursday, as retail traders weighed what some viewed as an attractive valuation for the marquee stock against growing frustration over its recent underperformance. Chatter also spiked as Amazon just set Oct. 30 as the date for its third-quarter results release.

Shares of the e-commerce and cloud giant are headed for their fourth straight weekly decline, marking their worst such stretch since early April.

"Markets gonna dump huge tomorrow but in the weirdest way that doesn't matter. Next week we should see you j***ed off enough and who didn't," said one user.

https://stocktwits.com/WolfCola/message/632683009

"$AMZN this dips will pay off long term," another said.

https://stocktwits.com/Emina1531/message/632684201

Amazon shares are down 10% from a recent peak hit on Sept. 9 and 2.2% year-to-date. That's way below the 12.7% and 16.8% gains in the benchmark S&P 500 and Nasdaq indices, respectively.

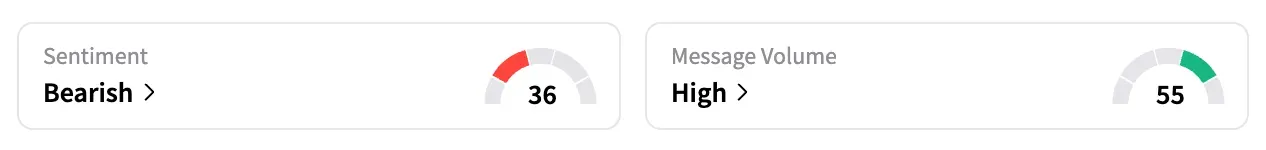

On Stocktwits, the retail sentiment for AMZN was 'bearish' as of the last reading, with the score dipping significantly from a day ago.

The weakness in Amazon shares this week comes amid volatile trading in the broader market, influenced by cues such as U.S.-China trade escalation and strong earnings from U.S. banks. A report on Tuesday noted that Amazon was planning significant cuts in its human resources division to rein in costs.

Last month, Amazon agreed to pay $2.5 billion as part of a settlement with the Federal Trade Commission for allegedly deceiving tens of millions of customers into signing up for its Prime program and sabotaging their attempts to cancel it. The company agreed to settle just as the agency's lawsuit was moving to trial.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Nintendo Asks Suppliers To Ramp Up Switch 2 Production As Holidays Approach

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248471134_jpg_9957fc576c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tandem_diabetes_resized_jpg_5f199c73c6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_82880353_jpg_0f9b1c5046.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228107699_jpg_f433126e50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_applovin_OG_jpg_12b141cd06.webp)