Advertisement|Remove ads.

Amazon Stock Slips After Lowered Sales Guidance For Q1, Slower Cloud Business Growth: Retail Shrugs It Off

Shares of Amazon.com Inc. ($AMZN) slipped nearly 5% in after-market trading on Thursday after the retail giant lowered its outlook for the next quarter despite a fourth-quarter earnings beat, but retail sentiment stayed strong.

Amazon reported Q4 earnings per share of $1.86, beating consensus estimates of $1.48, Fly.com reported. Reports Q4 revenue $187.8B, consensus $187.23B.

For Q1 2025, the company expects revenue of $151 billion to $155.5 billion, below the consensus estimates of $158.3 billion. The Q1 guidance includes a $2.1 bilion foreign exchange impact. Its operating income is expected to be between $14.0 billion and $18.0 billion, compared with $15.3 billion in the first quarter of 2024.

"This guidance assumes, among other things, that no additional business acquisitions, restructurings, or legal settlements are concluded," Amazon said.

Amazon’s capital expenditures were $27.8 billion in Q4, compared with $14.6 billion in the same period last year.

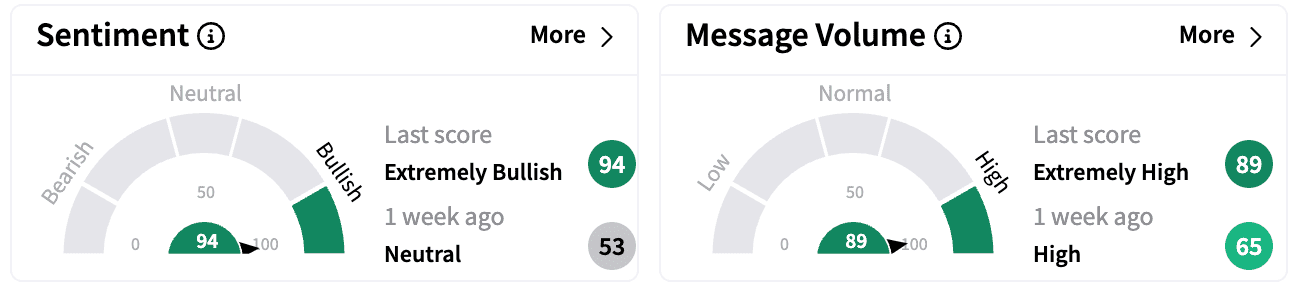

Sentiment on Stocktwits turned ‘extremely bullish’ from ‘neutral’ a week ago. Message volumes climbed to be in the ‘extremely high’ zone from ‘high.’

The retailer's cloud computing business saw lower-than-expected sales growth. The business reported grew nearly 19% year-on-year to $28.79 billion, missing analyst estimates.

The AWS business announced a number of recent initiatives including new foundation models in Amazon Bedrock from DeepSeek, Luma AI, and poolside, the company said in a statement. It also highlighted new features for Amazon Bedrock, including prompt caching, and model distillation, among others designed to help its customers achieve lower cost and latency.

“When we look back on this quarter several years from now, I suspect what we’ll most remember is the remarkable innovation delivered across all of our businesses, none more so than in AWS where we introduced our new Trainium2 AI chip, our own foundation models in Amazon Nova, a plethora of new models and features in Amazon Bedrock that give customers flexibility and cost savings, liberating transformations in Amazon Q to migrate from old platforms, and the next edition of Amazon SageMaker to pull data, analytics, and AI together more concertedly,” Andy Jassy, president and CEO of Amazon, said.

Amazon reportedly intends to invest more than $100 billion in capital expenditure this year towards generative AI services.

Amazon stock is up 9% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_strait_of_hormuz_jpg_456f2fb6d3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)