Advertisement|Remove ads.

Retail Sentiment For Amazon Holds Strong Ahead Of Q1 Report: Investors Await Tariff Strategy

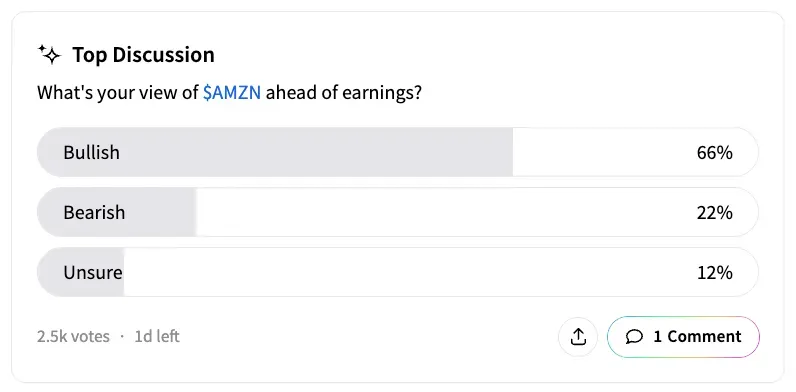

Two-thirds of users who voted on a Stocktwits poll about Amazon.com (AMZN) said they were 'bullish' ahead of the e-commerce giant's quarterly earnings on Thursday.

Amazon finds itself in a catch-22 position, where it has to either absorb higher costs from tariffs, which will hurt margins, or hike prices on its platform and risk losing market share, analysts have said.

Amazon's forecast will be the key focus, and investors will watch how it perceives and plans to manage the impact of the ever-changing U.S. trade policy.

Amazon's dual business model—spanning its vast e-commerce platform and the world's largest cloud computing service—complicates efforts to gauge the full impact of tariffs, which are expected to influence the behavior of consumers, third-party sellers, and enterprise clients alike.

"If these tariffs are going to stay in there for a long term, they're either going to have to eat [up] prices or they're going to have to lose market share," Evercore ISI analyst Mark Mahaney told CNBC.

UBS lowered its forecast for Amazon's 2025 revenue and operating profit for 2025 through 2027.

The company faced a bit of a public relations disaster on Tuesday, when a publication leaked news that Amazon might start listing import charges for goods on its site.

White House press secretary Karoline Leavitt hit back, calling the reported plan "a hostile and political act by Amazon."

Amazon later stated that it had considered the move for certain goods on its low-cost site Amazon Haul, but it was not approved and would not be implemented.

According to Koyfin data, analysts expect Amazon's first-quarter revenue to rise 8.2%, the lowest pace for the company since Q2 2022.

Adjusted profit is expected to be $1.36 per share compared to $0.98 last year.

On Stocktwits, retail sentiment for Amazon climbed a notch higher in the 'neutral' territory.

Amazon stock is down 14.6% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1238344200_1_jpg_9ec6a1a77a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_aurinia_pharmaceuticals_jpg_021df4af64.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)