Advertisement|Remove ads.

Amazon’s $38B Cloud Coup With OpenAI Reignites Wall Street’s Hope For AWS: ‘Important Validation’

- Amazon announced on Monday a seven-year deal to supply cloud computing capacity to the maker of ChatGPT.

- Retail investors and analysts say the deal is a major win for Amazon Cloud Services, which was previously seen as lagging behind its competitors.

- The move also demonstrates how OpenAI is rapidly expanding its cloud capacity beyond Microsoft, its primary backer and long-time vendor.

Amazon.com, Inc. won praise from all corners of the market after it announced on Monday a $38-billion, seven-year deal to supply cloud computing capacity to OpenAI.

The deal signals renewed confidence in Amazon Web Services, easing investor concerns that it was lagging Microsoft and Google in AI. The unit's performance last quarter also lifted the sentiment. As part of the deal, Amazon will deploy hundreds of thousands of chips, including Nvidia’s GB200 and GB300 AI accelerators, for OpenAI’s workload.

AMZN shares rose 4% on Monday, before paring some gains in the after-hours session. That followed Friday’s 9.6% rise, driven by the company’s strong quarterly results published a day earlier.

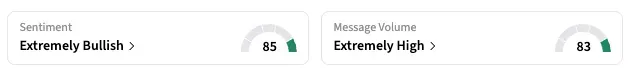

On Stocktwits, the retail sentiment held in the ‘extremely bullish’ zone from Thursday last week through late Monday. The message volume in the last 24 hours surged 544%, with many expecting a further, long-term appreciation in the share price.

“$AWS Considering recent ER, AWS rev acceleration and OpenAI deal this is no longer an AI laggard, was expecting this to be much higher today, as it should, I’ll hold and wait,” said one user.

‘Validation For AWS’

The deal is "an important validation for AWS on two fronts," BoFA analysts said in an investor note, according to a summary on The Fly. It would give AWS’s revenue growth a direct boost. Moreover, with major AI players like OpenAI and Amazon-backed Anthropic now using a combination of first-party and third-party chips on AWS, the cloud provider’s dual-chip strategy positions it well to meet customers’ diverse performance and cost requirements.

Evercore ISI analyst Mark Mahaney sees “material upside” for Amazon. OpenAI will run and scale its core AI workloads on AWS infrastructure; most of that capacity would come online by the end of 2026, with room to expand into 2027 and beyond, Mahaney said.

For Amazon stock, Wedbush analysts said the “current valuation is attractive and (we) see opportunity for further multiple expansion.” OpenAI will initially use existing Amazon Web Service data centers, with Amazon eventually building out additional dedicated infrastructure for the company, the analyst said in a research note, adding that the partnership "is a continued move in the right direction for Amazon.”

Wedbush raised its price target on AMZN to $340 from $330 while maintaining an 'Outperform' rating. Evercore ISI's Mark Mahaney also reiterated an 'Outperform' rating and a $335 target, calling Amazon his top "Large Cap' Net Long" pick. Meanwhile, Bank of America maintained its Buy rating with a $303 price target.

Cloud Worries Mitigated

Last month, Amazon reported the strongest growth within AWS since the fourth quarter of 2022 (+20.2%), reflecting increased capacity and encouraging demand across AI and core services. Moreover, Amazon stated that AWS capacity has doubled since 2022 and is expected to double again by 2027.

The company also raised its 2025 capital expenditure estimate to $125 billion, up from $118 billion previously, and stated that the figure is likely to increase next year.

OpenAI CEO Sam Altman previously stated that his company would invest up to $1.4 trillion to develop 30 gigawatts of computing capacity. Some of the plans are already in motion: OpenAI is developing 4.5G GW of capacity with Oracle in a deal worth $300 billion, and has committed $250 billion to additional capacity on Microsoft Azure.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)